Today Broadridge published a report exploring the metrics that cryptocurrency investors use to make decisions. Several of the survey findings are contrarian. For example, 65% of respondents identified themselves as long term investors rather than speculators. Perhaps because of this, most just want data updates monthly or quarterly rather than as they happen. And tokenomics ranks low on their list of preferred decision making metrics.

Dr. Chris Brummer of Georgetown Law helped with the survey.

With these sorts of results, the first question is who are the participants. Half of the 2,000 respondents were from the U.S. with the rest split evenly between Canada and the UK. True North Market Insights randomly selected people who identified themselves as current, previous or prospective crypto holders. They’re a reasonably well off bunch. Fifty-two percent of respondents in the US and Canada had investable assets between $100k and $500k, with another 20.5% above that. The Brits were a little poorer.

One indicator that may be a contributor to the results is the average age was older compared to the usual cryptocurrency demographics – 41% of respondents were aged 50 or above.

However, they invested a pretty significant proportion of their assets in crypto, averaging 27.9%. A significant number – 18.3% – invested more than half their assets in crypto.

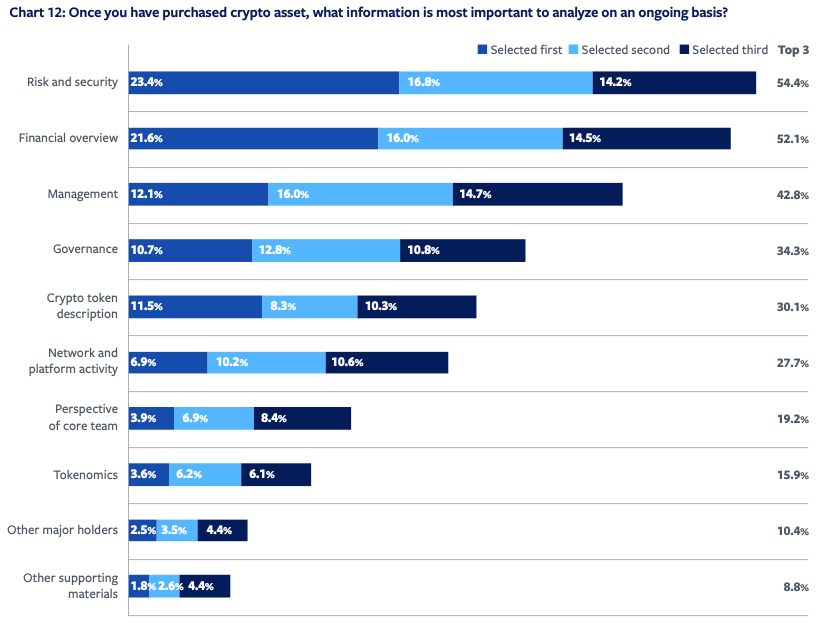

The really interesting response was around the preferred metrics. Conventional decision factors such as risk and security topped the list, which is unsurprising given the crypto market tumult. Financial overviews such as cash flows came just behind this. Two factors that were way down the list were network performance (28%) and tokenomics (16%).

The response on tokenomics is a surprise given it determines how quickly and to what degree the investment is diluted. The choice of metrics didn’t vary significantly based on wealth or region. One explanation proposed by the report authors was a lack of familiarity or understanding of tokenomics.

“To help better inform and educate investors, metrics that track crypto asset performance should be standardized, better disclosed and made more easily accessible, especially for retail investors needing the most relevant information and support possible to make informed decisions,” said Rob Krugman, Chief Digital Officer, Broadridge.

Meanwhile, last year Bank of America surveyed wealthy Americans and found that digital assets were the favored investment for growth opportunities for the 21-42 age group. Public stocks topped the list for those aged 43 or above, but didn’t rank in the top five for the younger age group.