Yesterday Boston Consulting Group (BCG) published a report that raises some questions about the suitability of blockchain for Commodity Trading. The consultants acknowledged that blockchain could improve transparency, help to track goods and reduce fraud.

Threats and opportunities

One of the observations is that there’s scope to improve standardization, efficiency, and tracking of goods without adopting blockchain. And blockchain won’t benefit all participants such as merchant traders.

For pricing and arbitrage, recording all transactions on a blockchain results in greater transparency and fairer prices. It would also reduce profits for those that rely on inefficiencies.

Currently, there are clearing risks and potential problems with fraudulent or poor quality physical delivery of goods. Almost real-time settlement would eliminate clearing risk. This would mean some counter-parties have to release collateral earlier. BCG acknowledges blockchain could reduce fraud by enabling tracking of inspections and certifications for physical delivery.

Regulatory oversight would have less friction because regulators could access the blockchain in real-time. The tricky part is the different regulations across jurisdictions.

ICOs enable companies to tokenize assets. BCG points to regulatory issues and states there’s a need to prove ICOs are a cheaper and better source of funding for sizeable industrial-scale commodity projects.

Companies in the sector have already made significant investments in IT systems and blockchain will require further additional investment. Each commodity sector will only realize the full benefits if all players participate.

BCG points to common misunderstandings that enterprise blockchain applications are similar to Bitcoin. Hence there are unfounded concerns about wasting power, scalability, and the ability to deal with complex applications.

The consulting group envisages issues with price-setting relating to speed. They assert it could take several seconds for a transaction to be verified and recorded which would be a drawback.

Impact on different commodity markets

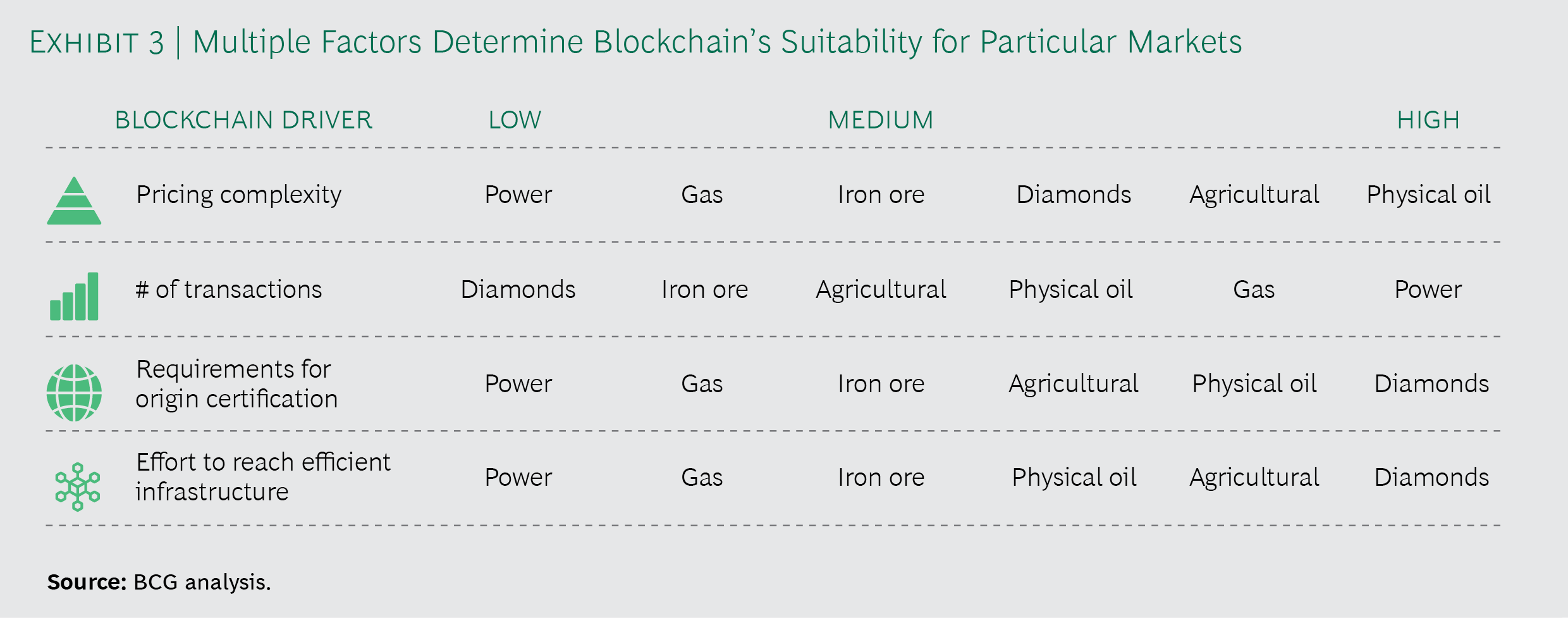

BCG used four variables to assess the impact on various markets such as diamonds, gas and power:

- pricing complexity and degree of diversity in pricing mechanisms

- transaction volumes and variation in consignment size

- requirements for foolproof certification of origin

- efforts to create a more efficient market structure

The consultants analyzed each sector in detail and produced the following result.

The report concluded that consortia formed around blockchain could act as a Trojan-horse to align market participants towards greater standardization.