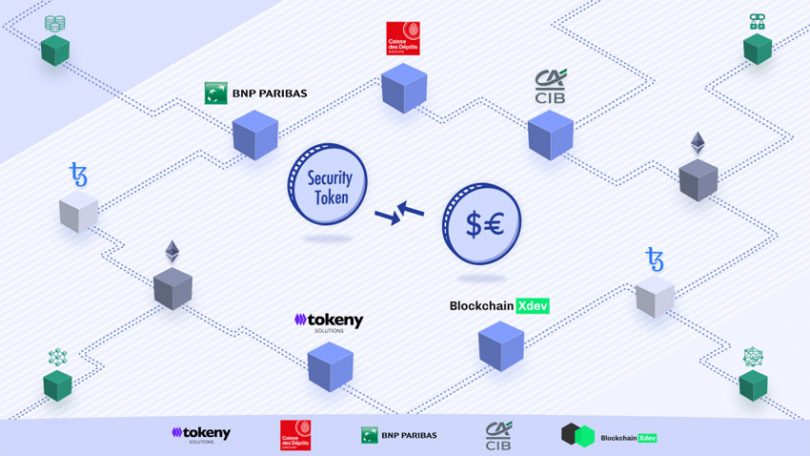

Last week a new project was unveiled to explore an interbank digital currency to settle security token transactions. The consortium involves the institutional arms of three French banks BNP Paribas CIB, Crédit Agricole CIB and Caisse des Dépôts, security token platform Tokeny and French development house The Blockchain Xdev.

The project has some similarities to Fnality, which is creating an interbank payment system. That project started in 2016 and is backed by 14 global banks and Nasdaq, but awaits the first central banks’ go-ahead.

The French group aims to explore instant atomic settlement or delivery versus payment. That’s for a settlement token to be used to make payment for transactions on a regulated securities exchange that leverages blockchain or distributed ledger technology (DLT).

We’ve asked whether, like Fnality, the plan is for the settlement token to be backed by deposits at the central bank, but we hadn’t received a response at publication time.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.