Today, Hong Kong blockchain startup Animoca Brands announced that it raised $88,888,888 at a US $1 billion dollar valuation. Since its delisting from the Australian Securities Exchange (ASX) just over a year ago, the company has come a long way.

Investors included Capital, RIT Capital Partners (formerly Rothschild Investment Trust), HashKey Fintech, Huobi, Ellerston Capital and others.

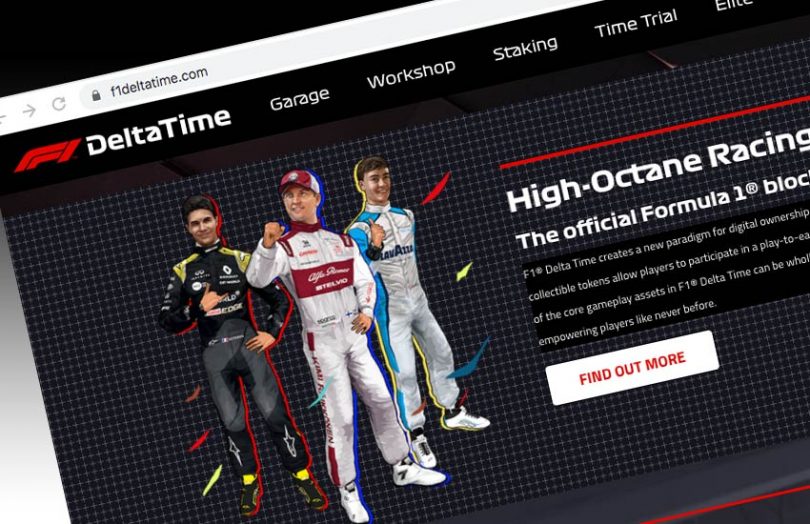

The company is a prominent player in collectible games based on nonfungible tokens (NFTs). It runs the officially licensed F1 Delta Time game in which users buy collectible cars. While it may be quite common for collectors to pay eye-popping amounts for NFTs in 2021, that was not the case in 2019, when Animoca was already auctioning NFTs for formula one cars for tens of thousands of dollars. The game has a REVV token and Animoca also licensed rights to MotoGP.

Another Animoca game is The Sandbox, a virtual world in which players can buy NFT land tokens. In late 2019, Animoca’s Sandbox subsidiary raised $2 million to fund the game.

In August last year, the company announced future games would use the Flow Blockchain from Dapper Labs, the NBA Top Shot developer. Plus, Animoca has invested in Dapper Labs, Opensea, Bitski, Axie Infinity and others. It says it plans to use the funding for acquisitions, developing products, acquiring rights or licenses, and other investments.

“We always maintained that gaming would be one of the first massive adopters of blockchain, and Animoca Brands is definitely the top game changer in this field,” said Deng Chao, CEO of HashKey Group. “As a blockchain-focused gaming company, it not only has a deep understanding of blockchain games and NFTs, but also strong development abilities in traditional games.”

In 2019 Animoca ran into trouble with the ASX when it downgraded previously reported revenue figures for the half-year to June 2019 from A$13 million to A$8.3 million. Many of the changes related to accounting for cryptocurrencies and token sales with the auditors taking a conservative view. Animoca positioned the delisting as ASX being uncomfortable with Animoca’s cryptocurrency exposure. There may be some truth in that. However, as a listed company, had Animoca resolved the accounting treatment before reporting unaudited figures, it might have avoided the ASX’s attention.