Bitmain the leading Bitcoin mining company and ASICS hardware producer, has filed a draft IPO prospectus to the Hong Kong Stock Exchange. The IPO document reveals that Bitmain is a hardware company. Many assumed that mining was a major source of its profits, but it doesn’t appear to be.

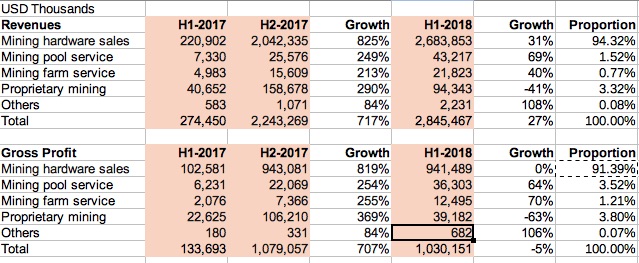

Three highlights in the figures. Firstly the growth in the second half of last year was exceptional. From the first half (H1) to the second half (H2) hardware revenue grew 825% to $2 billion. For hardware (only) that’s down to 31% from H2-2017 to H1-2018. Still respectable.

Secondly, the growth doesn’t look so rosy when you look at gross profit. From H1 to H2 of 2017 gross profit on hardware increased 819% to $943 million. But in H1 2018 hardware gross profit is fractionally down to $941 million compared to H2 of 2017. And the total gross profit is down 5%.

Thirdly, because the company holds significant cryptocurrencies at cost, the balance sheet is likely overstated materially.

Growth

In the first half of 2018 revenues were $2.85 billion of which 94.3% was hardware. Hardware also accounted for 91.4% of its gross profit of $1.03 billion for the same period. In 2017 it had a 74.5% market share of ASIC-based cryptocurrency hardware sales according to Frost & Sullivan. Adjusted EBITDA in the first half of 2018 was $1.12 billion (2017: $102 million). While it seems odd for EBITDA to be more than gross profit, the main reason is other income not included in revenue, 60% of which was gains on disposal of cryptocurrencies.

Growth rates were phenomenal, but perhaps unsurprising given the low starting base and the explosion of interest in the second half of 2017. So the first half revenue for 2018 was more than ten times 2017 revenue for the same period ($275 million). However, growth rates have slowed dramatically this year. Comparing revenues of H1 2018 with H2 2017, the rate is down to 27%.

Watch out for the crypto valuation

Bitmain accepts payments in cryptocurrencies. However, it does not revalue the crypto assets in the balance sheet. They are shown at cost. At the end of 2017, the figure was $872 million, and end H1 2018 $887 million. Given that as of today Bitcoin is worth less than half of the value at the end of last year, the balance sheet could be overstated by more than $400 million. If a large proportion of the holdings is Ether which is only worth 30% of the December value, then that figure could be worse.