Yesterday the Bank for International Settlements (BIS), the global body for central banks, published its quarterly report, which explored how technology is impacting banking and financial markets. It pulled together multiple papers covering payments technology, cross border payments, the decline of correspondent banking, tokenisation and securities settlement, and central bank digital currencies (CBDC).

BIS Head of Research Huyin Song Shini acknowledged that “the pace of change and potential for disruption have propelled payment systems to the top of policymakers’ agenda.” While the papers assessed emerging solutions, the challenges outlined are significant.

There was also a call to action. “Central banks have a core role in payment systems, and the changes under way require them to step up and play a more significant part in improving the safety and efficiency of these systems,” said BIS General Manager Agustín Carstens.

Securities tokenisation and settlement

Starting with securities, the paper explored the potential for tokenisation and blockchain or distributed ledger technologies (DLT). It makes the point that risks rarely disappear, but technology can change how they are managed.

The two key risks in trading are principal risk where someone pays but doesn’t get the asset, or vice versa. And replacement cost risk in which a transaction fails and the price has moved.

By shortening the time between the trade and settlement, especially for delivery versus payment (DvP) or instant settlement, DLT can reduce the replacement cost risk, but increase liquidity requirements.

The liquidity impact is because other settlement systems offer netting, meaning less cash is needed for payment at one point in time. That’s compared to DLT settlement systems, which offer instant settlement as a benefit. But the BIS pointed to a potential additional liquidity requirement if cash needs to be kept on ledger for multiple DLT platforms.

Blockchain also means there’s a shared ledger which reduces costs, especially the need to reconcile records with a Central Securities Depositary (CSD). That single source makes compliance simpler as well as shareholder voting and other stockholder actions. Smart contracts also can introduce efficiencies with automation.

However, the BIS outlined risks. The legal basis of tokens and settlement finality is uncertain, introducing operational risk. Additionally, the use of permissioned enterprise blockchains means there is some degree of centralization.

The paper emphasized that to avoid principal risk, payment and securities transfer must be tightly linked.

To date, securities settlement has been somewhat monopolistic. A proliferation of alternatives will introduce fragmentation. The paper concludes: “The ability of tokenised systems to interoperate with account-based systems will be key to their success.”

Cross border payments

The report reviews the evolution of cross border payments, and the G20 has made this topic one of its priorities for 2020. However, reading this BIS paper shows this will be a significant challenge.

Cross border payments are slow and expensive. The paper gives a list of reasons including cross-border governance, different laws, anti-money laundering and other compliance requirements. Added to this is the currency conversion and liquidity management of foreign currencies.

The quarterly report has an entire section dedicated to the decline in correspondent banking. There’s a risk this could make the current system even more expensive.

The cross border paper explores the different types of systems. These include “offshore systems” which allow foreign currencies to be settled within the country. An example given is Hong Kong, where its Real time Gross Settlement System (RTGS) allows four currencies: HKD USD EUR and RMB.

Another approach is single currency cross border systems. These take two forms. In one case, a central bank may allow foreign banks to make payments within their local system. For example, the ability of offshore banks to make Swiss franc payments within the domestic Swiss system. Another example is interlinking between two systems. Again in Switzerland, all euro payments are channeled via the Swiss Euro Clearing Bank.

And finally, the more complex route is multicurrency cross border payment systems.

There are major challenges in setting up new cross border payment systems. Never mind the forex conversion and liquidity, there’s a need for interoperabilty, which is non-trivial. Then there’s the compliance issues, the legal issues, and more than anything, a shared political will.

The response to stablecoins from central banks and regulators appears to be to improve cross border payment systems, or – considered a more extreme response – to introduce a Central Bank Digital Currency. Both are tricky.

Central Bank Digital Currency

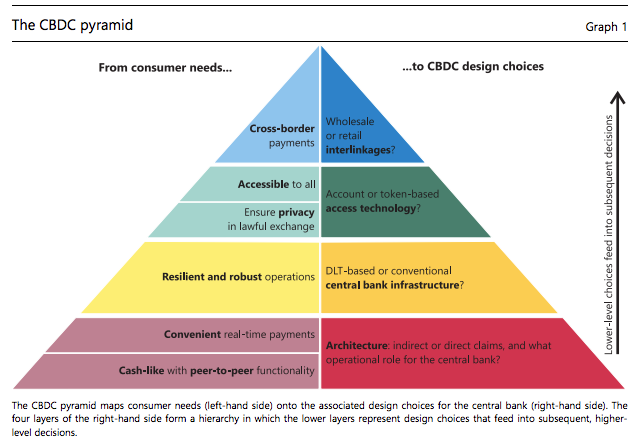

The paper explores different technical design approaches to Central Bank Digital Currencies. One of them is whether it should use DLT or not. Another is whether it should be account or token-based.

The conclusion is that more hands on experience with the different design choices is needed. It notes that central banks around the world are experimenting with a vast array of designs which should help to build a picture.

As with most other CBDC research, it concludes that the optimal design will depend on the jurisdiction.