Yesterday, the Bank for International Settlements (BIS) published the results of its survey on central bank digital currency (CBDC). While most banks are still researching the implications, the BIS says central banks representing one-fifth of the globe’s population could issue a CBDC soon. Although not singled out by the BIS, China’s high profile digital currency / electronic payment (DC/EP) accounts for a significant proportion of that.

However, 70% of central banks still say they are unlikely to issue a CBDC in the foreseeable future. The big news is that 10% envisage adopting a general purpose CBDC in the short term (within three years).

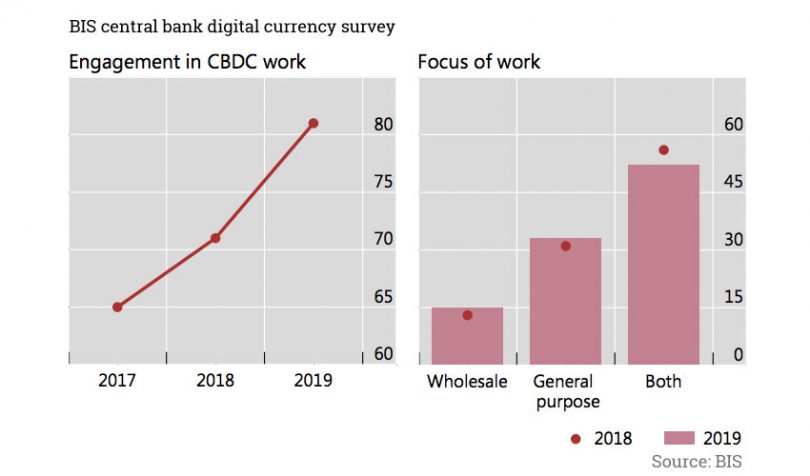

Exploration has accelerated. While 70% of central banks were exploring digital currencies last year, the figure is now 80%. In terms of progress, half of the active banks are still at the pure conceptual research stage, 40% have conducted experiments, and 10% are at the pilot stage. The latter group were all in emerging markets.

Some central banks are focused on providing a CBDC for financial institutions, a so-called wholesale digital currency, while others are concentrating on a retail or general-purpose version. More than half are exploring both, with 15% of central banks purely focused on wholesale. About 32% are concentrating on retail CBDC.

Looking at individual countries, it seems that most nations have unique needs that the central bank is trying to address. For example, Sweden has declining access to cash and a private institution operating most digital payments. In other countries, there’s still very significant cash usage, which also carries high operational costs.

The BIS noted that overall, cash in circulation is increasing, but high denomination notes account for a large proportion. So cash is being used as a store of value rather than for payment.

Yesterday at the World Economic Forum in Davos, the BIS’s Benoît Coeuré observed the different motivations. “Emerging market colleagues say that’s a good [tool for] financial inclusion and that’s about reducing the use of cash,” said Coeuré.

He continued: “Colleagues in advanced economies tell us that it’s more about making sure that they will keep the link between citizens and the central bank in the face of the disappearing use of cash.”

Overall, the BIS found that emerging markets had stronger motivations for working on general-purpose CBDCs, particularly for monetary policy implementation, financial inclusion and payments efficiency. For advanced economies, financial inclusion scored lowest as a motivation. Financial stability and payments safety ranked highly for both types of economies.

A key question is whether a central bank has the right to issue a digital currency. The survey found that 25% of central banks have authority, or will soon. A third do not have the legal right, and 40% are unsure about the legal status.

The BIS also asked the banks about the impact of stablecoins. Only 60% of central banks are considering their impact, and those that are not are almost exclusively emerging market economies.

The survey was conducted in late 2019 and covered 66 banks, including 21 advanced economies and 45 emerging ones, and overall covered 75% of the world’s population.