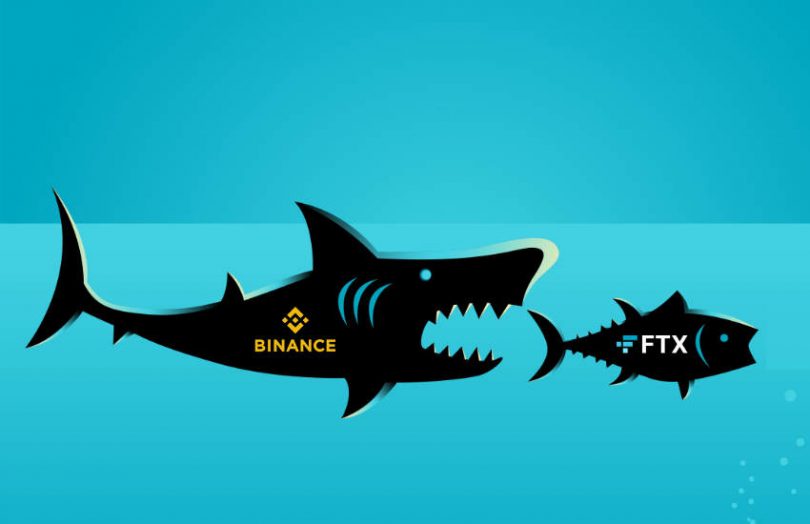

Just over an hour ago, Changpeng Zhao (CZ), the CEO of Binance announced it was acquiring FTX.com, the non-U.S. arm of the FTX cryptocurrency exchange. It follows a rash of liquidations at the FTX exchange since Sunday. That’s when CZ announced Binance’s plans to sell its holdings of the FTX token, FTT, and cited lessons learned from LUNA, the token collapse that caused the May crash.

After the deal announcement, the FTT token price recovered. However, it has since collapsed further to less than $12, a drop of more than 50% since Saturday.

CZ wrote on Twitter, “This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days.”

The transaction is for the international arm of FTX, not FTX.us, which FTX CEO Bankman-Fried says is currently operating normally.

“The important thing is that customers are protected,” wrote Sam Bankman-Fried, FTX’s CEO.

“I know that there have been rumors in media of conflict between our two exchanges, however Binance has shown time and again that they are committed to a more decentralized global economy while working to improve industry relations with regulators. We are in the best of hands.”

However, yesterday diplomatic Tweets from each CEO yesterday were followed by single Tweets indicating evident friction between the two. We’ll come back to that.

A few hours ago, on-chain data indicated that FTX.com had stopped processing withdrawals. Additionally, Bankman-Fried, a regular on Twitter, suddenly went quiet and had not posted for almost 24 hours.

The flood of withdrawals yesterday was followed by a sudden sharp drop in the price of the FTT token last night from around $22.00 to less than $18 in a little over 30 minutes. It continued to sink to around $15.50. When the acquisition deal was announced, there was a big spike in the FTT price back to $20, which has since dropped to below $10.

The impact of the deal

On the one hand, if FTX users are protected, it is good news for the cryptocurrency sector. But it could be better for competition. Binance is already the dominant exchange internationally, with second-placed Coinbase clocking around 20% of its volumes. FTX was one of its up-and-coming competitors.

It also raises a number of regulatory questions. These include why regulators have been so slow to regulate centralized exchanges after the collapse of several crypto lenders, what started the run on FTX, and particularly what triggered the sudden collapse in the FTT token price. The latter might have been a shortage of funds to support the price, but that’s speculation at this stage.

The Sunday tweets before the stampede

Last week Coindesk published snippets from the balance sheet of market maker Alameda Research which FTX CEO Bankman-Fried also owns. It showed Alameda held $14.6 billion in assets at the end of June, including $3.66 billion in unlocked FTT and $2.16 billion in FTT collateral. Despite concerns about the linkages between the two firms, the FTT price slipped 15% and recovered. And FTX didn’t seem impacted.

A few days later, on Sunday, CZ tweeted plans to sell Binance’s holdings in the FTT token, which it acquired after converting its equity holdings in FTX. And he followed it up with this tweet.

“Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t support people who lobby against other industry players behind their backs. Onwards,” tweeted CZ.

The lobbying has been assumed to be Bankman-Fried’s activity in Washington. The FTX CEO has had a significant media presence, and sentiment shifted after the publication of FTX’s stance on regulation, particularly DeFi, which it published less than three weeks ago.

That unleashed a wave of negative reactions from parts of the crypto community, particularly following his participation in a Youtube debate. And since then, Bankman-Fried has been on defense.

Yesterday, the FTX CEO tweeted, “A competitor is trying to go after us with false rumors.”

Patrick Hillman, Chief Strategy Office at Binance, also tweeted yesterday, “Let’s be clear, Binance did not:

- Define @SBF_FTX stance on DCCPA

- Debate @ErikVoorhees (the youtube video) on the merits of FTX’s stance

- Get into shitpost Twitter fights with KOLs

- Manage nor leak Alameda’s balance sheet

- Write the @CoinDesk story

- Fail to address concerns about FTT.”

Perhaps not. But Binance did raise the straw that broke the camel’s back.