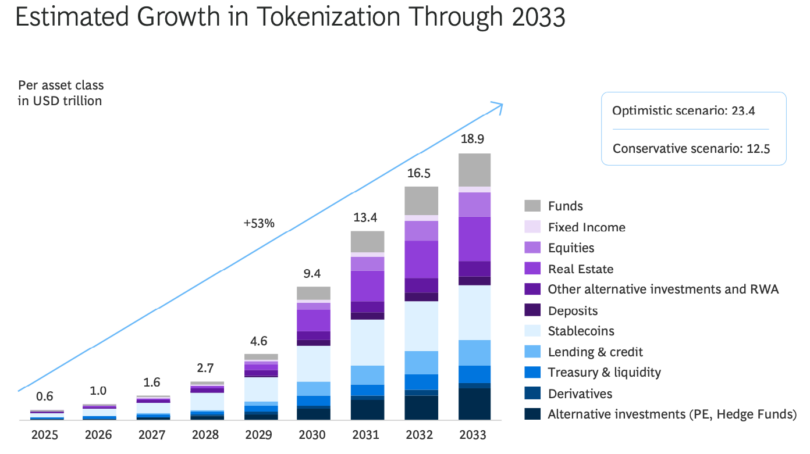

Yesterday Ripple published a tokenization report developed by Boston Consulting Group (BCG), which predicts tokenized assets will reach $18.9 trillion by 2033, including stablecoins and tokenized deposits.

The report outlines three stages of adoption. It describes the first phase as low risk adoption, including pilots involving money market funds and corporate bonds. BlackRock’s BUIDL tokenized money market fund launched in 2024 is given as an example, alongside Singapore’s Project Guardian. Rather than attempting to scale, the goal of this phase is institutional readiness.

Phase two starts to involve more complex assets such as private credit, structured finance and corporate bonds. The aim is to earn a return, enhance liquidity and enable composability, as opposed to the simpler transactions in the earlier phase. This is when institutions start to move beyond private blockchains to explore permissioned public blockchains. However, BCG observes some reluctance from institutions to collaborate to reshape markets as they want to defend existing revenue streams.

Market transformation is achieved in phase three. The tokenized asset classes expand to include private equity, hedge funds, infrastructure and real estate-backed debt. This step requires secondary markets with sufficient liquidity, as well as the willingness to accept tokenized assets as collateral. We’d observe that aspects of each phase are currently in evidence, although the current market status fits closest with the early steps of phase two.

Profitable tokenization use cases

The report also explores various use cases, identifying by far the largest benefits from trade finance, followed by collateral and liquidity management. We’d observe that four major trade finance initiatives were perhaps ahead of the curve, with three of them (Contour, Marco Polo, we.trade) shuttered in the past few years and komgo remaining. This experience could retard the future institutional adoption of tokenization for trade finance. However, a foundational document is the electronic bill of lading (eBL), and there are signs of early traction in this area. Plus, other new institutions might embrace tokenization. For example, stablecoin issuer Tether is starting to plow funds into commodities trade finance.

Tokenized collateral management was the second most profitable use case identified, with potential savings of $150 million to 300 million for every $100 billion in daily repo. We’d observe this is one of the use cases receiving the most attention in traditional finance at the moment. The moves in the United States by the CFTC to support tokenized collateral in derivatives markets is a massive step forward. As is Germany’s BaFin approval of digital collateral in repo markets.

Reconciling past tokenization predictions

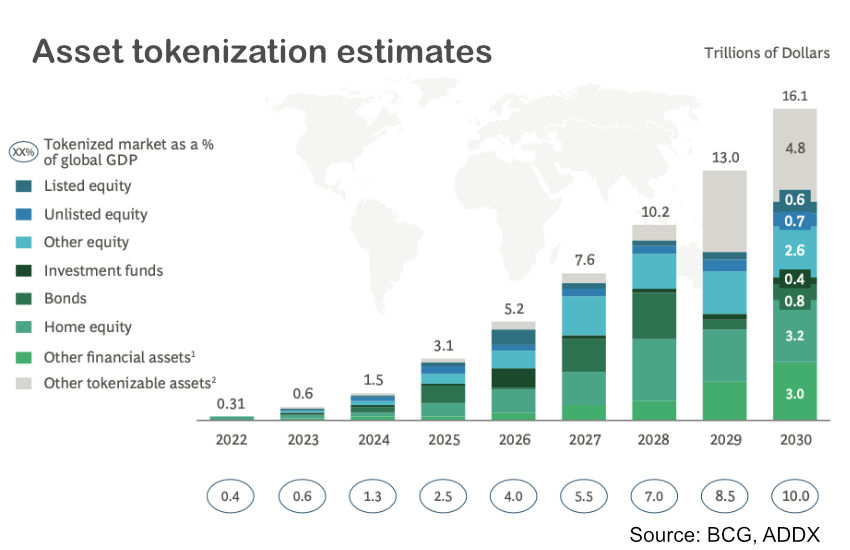

Those monitoring the tokenization sector for more than a couple of years, may recall that in 2022 BCG predicted that tokenized assets would reach $16 trillion by 2030, compared to $9.4 trillion by the same date in the current report. Time has moved on, and that early traction has not yet transpired. Hence, the need for the revision. Today’s report predicts that tokenized assets in 2025 will reach $600 billion including stablecoins, compared to the $3.1 trillion forecast three years ago without stablecoins:

However, the gap between the two predictions is far greater than $6.6 trillion. That’s because the earlier forecast excluded stablecoins and tokenized deposits. Removing that figure reduces the latest 2030 forecast to around $6.4 trillion, or just 40% of the previous forecast.

That said, the bell curve of innovation adoption means estimating the take off point is the trickiest and most important aspect of a forecast. Erring the other way, by forecasting a late traction point can significantly underestimate the market potential. As the report highlights, there are still some important hurdles to the adoption of tokenization, a major one being fragmentation. Addressing that is key to the sector reaching its trajectory.