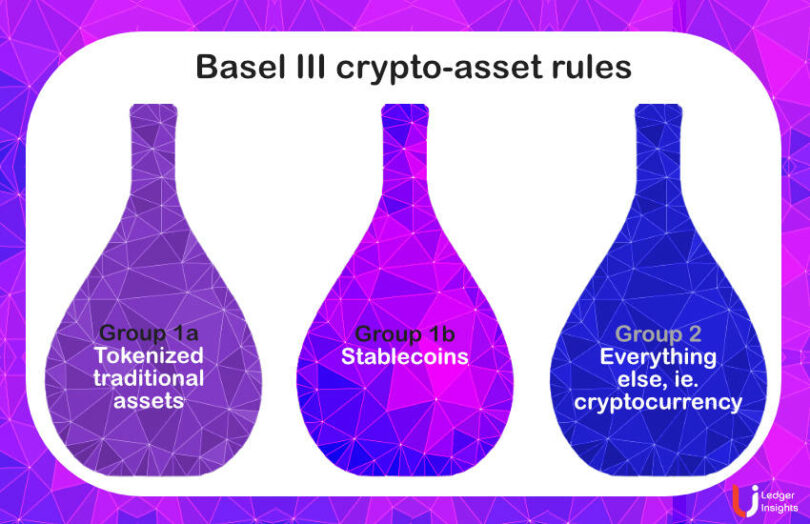

Today the Basel Committee for Banking Supervision published the final version of the rules for crypto-assets to be implemented by January 1, 2025. The rules cover the capital requirements for risk exposures relating to digital securities, stablecoins and cryptocurrencies and follows two rounds of consultations.

The second version of the rules was far stricter than the first and received strong pushback from the banking sector. The latest rules are still strict but have been relaxed in key headline areas.

The highlights:

- The 1250% risk weighting for unhedged cryptocurrency exposures remains, which means a dollar of capital has to be set aside for every dollar of exposure

- The high risk weighting does not apply to assets held in custody. Had this remained, it would have prevented banks from providing crypto custody at scale.

- Previously, Basel proposed an infrastructure risk add-on of 2.5% for digital securities and stablecoins. This has been waived by default. However, it can be imposed on a bank if there’s a perceived infrastructure risk

- Cryptocurrency exposures are still limited to 1% of Tier 1 capital with new significant relaxations for hedging. The 1% can be exceeded, but it should not go above 2%.

- The tests for assessing low risk stablecoins have changed. It is now a combination of redemption risk and regulatory supervision but will evolve.

Pablo Hernández de Cos, Chair of the Basel Committee and Governor of the Bank of Spain, said, “The Committee’s standard on cryptoassets is a further example of our commitment, willingness and ability to act in a globally coordinated way to mitigate emerging financial stability risks.”

“It is important to continue to monitor bank-related developments in cryptoasset markets. We remain ready to act further if necessary,” added Tiff Macklem, Chair of the GHOS (Governors and Heads of Supervision) and Governor of the Bank of Canada.

Basel III crypto evolution

The Basel Committee isn’t treating the set of rules as static and plans to monitor and evolve several areas.

It has reservations about the risks of digital securities and stablecoins on permissionless blockchains and wants to assess “what adjustments to the classification conditions would be needed.” By classification, it means to remain in the group 1 low-risk group.

Stablecoins are not eligible to be treated as collateral for Basel III capital calculations, but this could evolve in the future. It will also monitor and potentially reassess hedging thresholds and the cryptocurrency 1% and 2% caps.