During this week’s recent meeting of the Basel Committee on Banking Supervision, a decision was made to require banks to provide disclosures of their crypto-asset exposures. This is in addition to the crypto-asset rules finalized last year that define how crypto-asset exposures impact bank capital and liquidity requirements.

In the United States, crypto disclosures are a controversial issue. Last year, the SEC issued a staff accounting bulletin that impacted all listed companies with crypto exposures, not just banks.

It required them to put crypto-assets held in custody on the balance sheet as both an asset and a liability. This is a very unorthodox treatment, given the assets do not belong to the custodian. The SEC’s rationale is the heightened security risks of keeping digital assets under custody. If a hacker is successful, the banks will be liable to their clients.

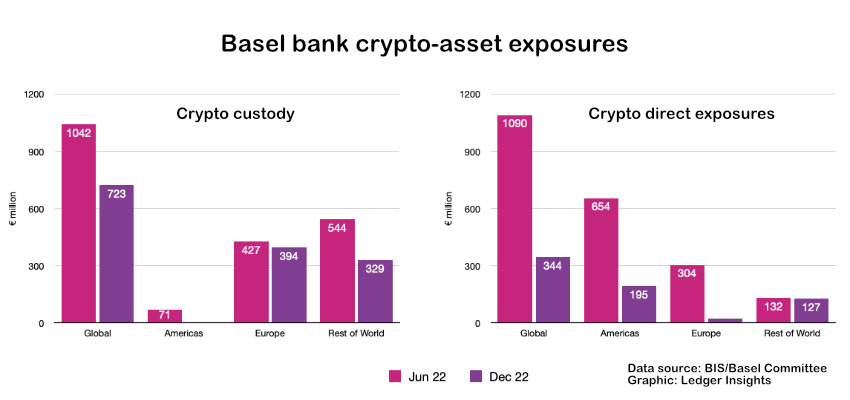

U.S. banks have inferred that this requires them to additionally comply with Basel capital rules as if they own the custodied crypto-assets. In other words, to custody crypto they believe this requires a dollar-for-dollar capital requirement, meaning crypto custody services are not financially viable. Recent Basel statistics, while not definitive, indicate zero crypto custody services provided by banks in the United States.

The U.S. banks’ belief that the SEC accounting rule impacts the capital requirements is in conflict with the international Basel crypto-asset rules that explicitly do not require this treatment for custody. Last month, the Chair of the SEC Gary Gensler clarified that to impact bank capital requirements was not the intent. He said that bank capital requirements are a matter for banking regulators, not the SEC.

Meanwhile, another topic that clears the way for bank accounting disclosures is the recent finalization of an accounting standard by the US-focused Financial Accounting Standards Board.

Crypto impact on 2023 banking failures

Also today, the Basel Committee published a report on the recent banking failures. It considered the rise of crypto as one of the indirect factors that impacted banking generally since the 2008 crisis. Additionally, it noted the small exposure of banks. However, where there is bank activity, it tends to be concentrated.

In the case of Signature Bank, it said the bank failed to understand the risks associated with its reliance on crypto industry deposits. That was because traditional depositors were aware of the bank’s exposure and its stock price tracked several major negative crypto events. Hence, the risks were not just directly crypto related but also indirect because other depositors reacted by reducing their deposits.