A little speculation

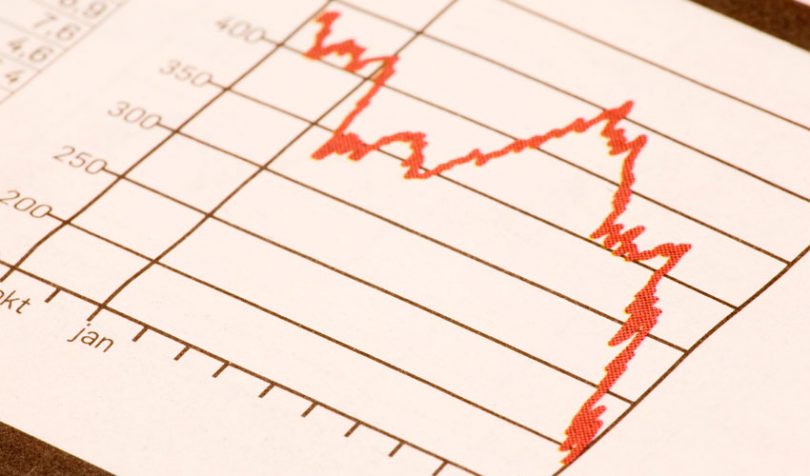

Ledger Insight’s interpretation is there’s a good chance that “treatment” could involve additional capital requirements for bank cryptocurrency exposures. Given the volatility of cryptocurrencies the capital needs could be significant which would be a deterrent to adoption by financial institutions.Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: leaf / BigStock Photo