The Basel Committee on Banking Supervision has published Basel III monitoring statistics for June 2024, including digital asset exposures. Statistics for US banks showed massive swings from previous periods. Although US banks continue to hold very few cryptocurrencies on their balance sheet, in late 2023 they provided significant services to clients to the tune of €190 billion ($205 billion). However, by June 2024 the client figure had collapsed to under €5.8 billion.

This may be consistent with the many letters sent by the FDIC to banks discouraging them from engaging with crypto-assets, including blocking them from providing client access.

There’s one important caveat. Basel figures are based on a statistical sample. While there were eleven banks from the “Americas” in both the December 2023 and June 2024 figures, they won’t necessarily have been the same banks.

ETPs lead to growth in crypto-related custody

Another figure that showed a very substantial swing was digital asset custody. In just six months, the American figure jumped from €94 million to €333 billion ($359 billion). This was before former SEC Chair Gensler began providing exceptions to SAB 121, the rule (now rescinded) that blocked banks from providing custody. The reason for the ballooning figure is that banks provide custody for Bitcoin ETFs.

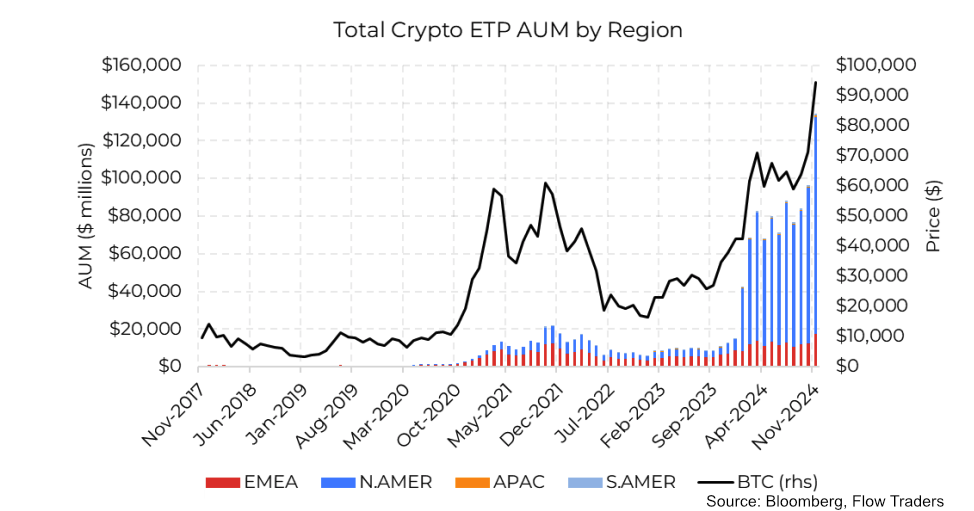

While the €333 billion figure was 100% attributed to ETPs, the scale of the figure is curious. Looking at the graph below, total crypto ETP assets under management were only around the $110 billion mark in June 2024. So the bank custody figure appears to be more than three times this. Even if the ETP figure included unlisted funds, they are unlikely to be of this scale.

Finally, regarding prudential exposures – where banks put digital assets on their own balance sheets – Europe trebled its exposures to €2.6 billion. Plus, the type of exposure switched from mainly ETPs (60%) to primarily spot crypto (69%).