In September the Korean press reported that the central bank was preparing for a tokenized deposit trial targeting around 100,000 people. It follows the Bank of Korea announcing formal plans for such a trial a year ago, in combination with a wholesale central bank digital currency (wCBDC) for interbank settlement. Yesterday the central bank signed an agreement with the Ministry of Science and ICT (MSIT) and the Financial Services Commission (FSC) for the usability tests.

In June MSIT and the Korea Internet & Security Agency (KISA) awarded a budget to the Bank of Korea to develop a voucher program using smartphones, where the vouchers can be used to purchase welfare, culture, education and other goods and services.

Hence, the central bank has developed a digital voucher management platform which aims to address the complexities of settlement relating to paper vouchers and the potential for fraud. Based on previous disclosures, the vouchers will use Singapore’s purpose bound money (PBM) model, which essentially wraps the deposit token in a smart contract which defines the token’s conditions of use.

The FSC has approved seven domestic banks for participation as innovative financial services, although the banks compliance will be continuously reviewed. They are Kookmin, Shinhan, Woori, Hana, Industrial Bank of Korea, Nonghyup, and Busan. Notably, the deposit tokens will be covered by the conventional deposit protection system. So far the central banks has not released the details about user recruitment and the vouchers.

Digital currency options

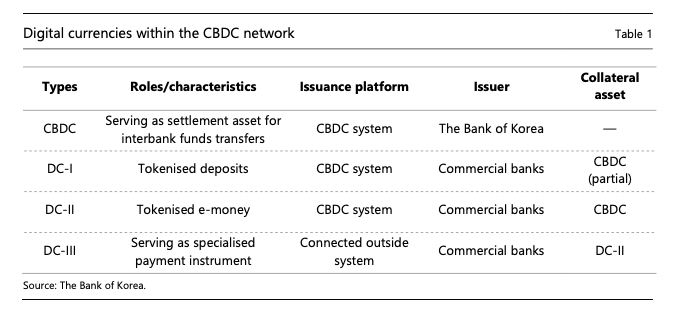

Stepping back, the tokenized deposits are conventional bank deposits represented on a distributed ledger (DLT) controlled by the central bank – its CBDC system. When a client transfers a token issued by one bank to a customer that banks with a different bank, there’s a need for interbank settlement. That happens using a wCBDC.

However, when Korea announced plans for the trials last year, it also outlined two other potential digital currency use cases. One is for an e-money token fully backed by the wCBDC and issued on the shared ledger. The key difference is the tokenized deposit is backed by fractional reserves. These e-money tokens could be issued by commercial banks, and potentially by other payment service providers in the future .

If digital currency tokens are to be minted on third party blockchain platforms, such as for securities settlement, then these would be a separate type of e-money tokens. Given they are issued on a third party platform, they would have to be backed by e-money tokens issued on the shared CBDC ledger. Hence, Korea’s framework has four types of digital currencies.

Ledger Insights Research has published a report on bank stablecoins, tokenized deposits and DLT payments, which outlines important design considerations, some of which are sometimes overlooked.