Yesterday the Bank of Japan (BoJ) published a research paper on central bank digital currency (CBDC). As with previous papers, the Bank explored a specific topic, in this case, the potential offline use of a digital yen.

Although it’s a research paper, the Bank recognizes there will be a growing need for a digital currency with the steady decline in the use of cash. However, in Japan, four out of five retail transactions still use cash.

The Bank considers two critical features of a CBDC are universal access and resilience. That means using the digital yen without electricity, especially given Japan’s recent earthquakes and power outages.

In terms of universal access, the Bank says: “we will not limit the users who can use CBDC”. So it won’t restrict access to a specific device and quotes a figure of 65% smartphone penetration in Japan.

The paper very briefly explored the potential for a centralized versus a decentralized CBDC and stated that potentially both could be made capable for offline use. But it’s quite keen for additional functionality from programmable money and to future proof any payment system. It also examined an account versus a token-based currency. Our interpretation of the automated translation is that they came down on the side of tokens because we can’t see how offline usage is viable for account based.

How to enable offline CBDC payments

The bulk of the paper explored how to enable offline payments. Firstly it examined using a chip (IC) on a sim card but with a feature phone rather than a smartphone. The conclusion was it was impractical for several reasons, not least that it wouldn’t be user friendly.

For each of the device options, the Bank’s analysis for offline readiness was based on five criteria. It considered how it can store monetary value, communication between users, verification of the transaction including by users, the ability to enter a payment instruction, and whether the data can be stored without electricity.

For smartphones, given they are already used for wallets, they match all the criteria.

The bank explored the potential use of PASMO/Suica cards, which are used for railway and transport ticket passes as well as electronic money. One of the biggest drawbacks is there is no way to enter a value to pay in an offline scenario. Potentially it could communicate with a smartphone that could be used to enter the amount of payment.

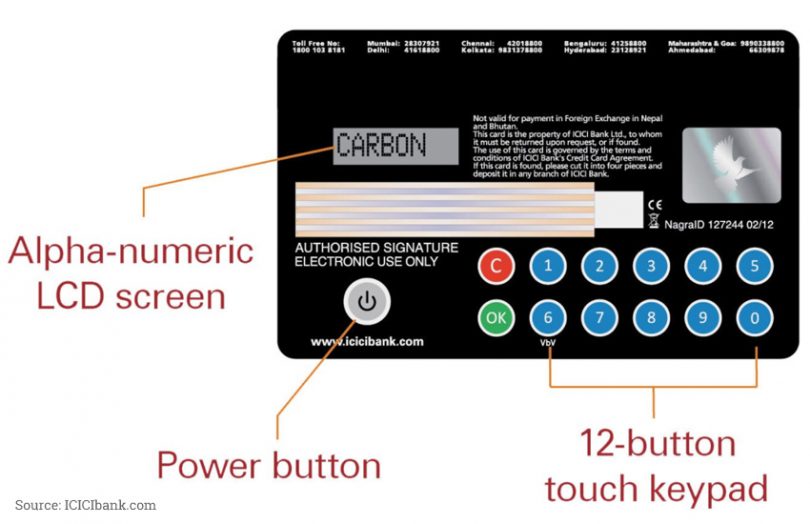

Next, there is potential for more advanced debit cards with mini keypads built-in and a tiny display, such as the one from ICICIbank in the image. The BoJ considered storing a private key on such a card or a wearable device as a technical issue, but possible. The cards need to work in close proximity, and authentication may need a fingerprint reader and a password. The mini keypad and display enable an amount can be entered and checked. And the cards are designed to store data.

The big challenges with offline transactions will be security, combatting counterfeits as well as anti money laundering processes. In terms of preventing double spending, the Bank mentions a locking mechanism so that the ledger’s amount can’t be transferred until it communicates with the device.

It suggests there will be multiple attack vectors. For example, with the chip enabled card, the IC chip will be the target of direct attacks, and indirect attacks might target private keys by monitoring electromagnetic communication waves. There’s also the risk of counterfeits. The Bank says frequent software updates are needed to address attacks, and for any offline devices, they may need to be replaced regularly.

Last year the Bank of Japan released papers exploring the legal aspects of a CBDC as well as the practicality of a retail CBDC. And since 2016, as part of Project Stella it has collaborated with the European Central Bank for research. They’ve covered DLT for liquidity savings, DLT for Delivery v Payment (or instant settlement of securities transactions), and most recently, DLT for cross border payments.