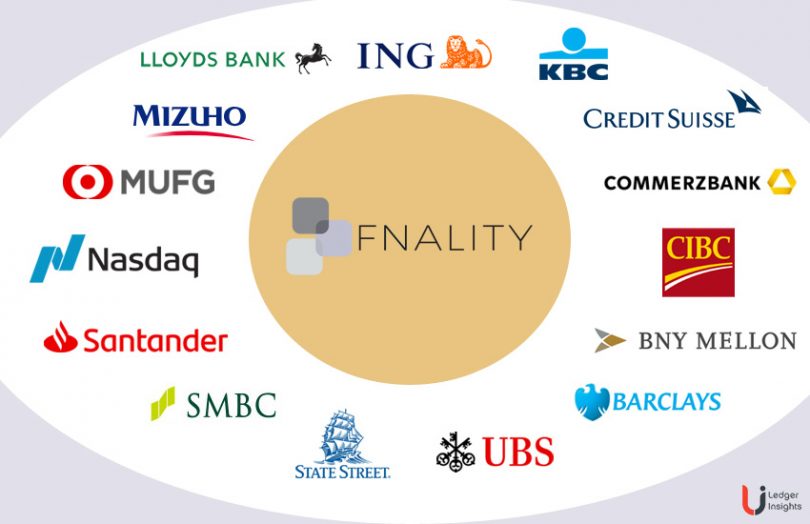

Today the Bank of England (BofE) unveiled a new kind of central bank account that means that Fnality, the firm founded by 15 major financial institutions, will be able to go live once it’s approved. Fnality, formerly known as the Utility Settlement Coin (USC), is designed to enable banks to settle with each other on blockchains using tokenized money based on a common account at the central bank.

Fiat cash on ledger is seen as the missing link to unlock much of blockchain’s potential in an institutional setting because it enables instant settlement removing counterparty risk. A typical scenario where this would be useful is if banks want to conduct securities settlements using a blockchain, an area of significant activity, particularly for bonds.

What the Bank of England announced today was an Omnibus account which ‘co-mingles’ funds from different entities for the purposes of wholesale settlement. The firms that do the co-mingling will be regulated entities with access to central bank money. Fnality has already applied to open an omnibus account.

However, the BofE announcement clarifies that the account is not limited to wholesale transactions such as buying gilts and can be used to settle transactions on behalf of customers, such as a small business paying a supplier.

“We are delighted that the Bank of England has published a formal policy statement outlining the omnibus account eligibility criteria for innovative payment systems like Fnality. This policy is a key enabler in delivering game changing use cases on our new payment system,” said Rhomaios Ram, Fnality CEO.

Any payment system such as Fnality that uses such an account is not limited to the real time gross settlement system (RTGS) operating hours, provided any needed funding was added to the account during RTGS working hours.

Apart from also enabling intraday transactions and liquidity, a system such as Fnality’s has advantages over single bank tokens precisely because it can enable interbank transactions.

“It is exciting to see this development from the Bank of England supporting the opportunity to use tokenised cash assets on next generation payment systems, enabling on-chain wholesale exchange of value,” said John Whelan, MD Digital Investment Bank & Innovation, Banco Santander. Whelan spearheaded Santander’s issuance of a digital bond on the public Ethereum blockchain.

Fnality uses a permissioned blockchain based on Ethereum. Clearmatics was the early technology developer, but early last year Fnality announced a partnership with Adhara. It’s planning to run on chain payment systems in multiple currencies with a regulated subsidiary in each jurisdiction.

When a bank wants to use Fnality tokens to make a payment, it transfers money from its central bank account to the Fnality omnibus account, which then tokenizes it. The bank then uses the tokens to make a payment, and the recipient bank can then opt to convert the received tokens back to central bank money and have it transferred to its own central bank account. Or it could use the tokens for further payments.

“Having been involved from the start of the Fnality journey, it’s great to see the publication of this policy,” said Hyder Jaffrey, MD – Head of Principal Investments, UBS Investment Bank. “It highlights the progressive and forward-thinking approach taken by the Bank of England to support innovation in global payments. This approach will enable us to develop new settlement models, bringing significant market benefits to all stakeholders.”

Elsewhere, JP Morgan is working with DBS Bank and Temasek on an interbank settlement system in Singapore.

Today, the Bank of England also announced the creation of a Taskforce with HM Treasury to explore a potential sterling CBDC.

Update: The article was updated adding Adhara as technology partner.