Yesterday the Head of Future Technologies at the Bank of England, William Lovell, shared his views on the progress of UK central bank digital currency (CBDC) research. In the blog post, he envisaged a digital future where different apps based on a CBDC can deal with the various use cases that cash currently addresses. The Bank of England is seeking feedback on CBDCs and stablecoins by early next week.

“Currently, the Bank of England (BoE) is actively exploring the case for a possible central bank digital currency (CBDC). I should point out, though, that no decision has been made at this time,” wrote Lovell

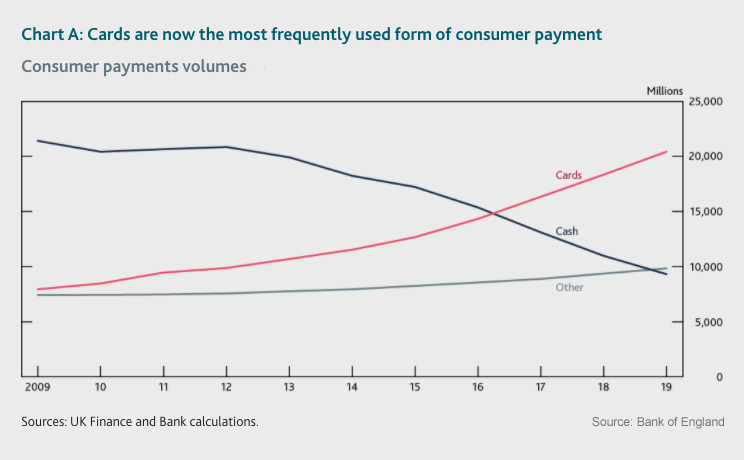

When it comes to CBDC research, each country has specific motivations and design issues. Countries such as Sweden are ramping up their CBDC testing due to the rapid decline in cash usage. Last year, GlobalData identified Finland, Sweden and China as the leaders in the race to a cashless society. The U.K. was not far behind in the fifth spot. While Lovell did not mention the global ranking, he highlighted that cards overtook cash usage in the UK several years ago.

According to Lovell, much of the demand for digital cash in the UK would stem from online and retail purchases. It could even be an attractive way for companies to make payroll.

“In the same way that existing electronic payments have evolved uses that no one envisaged, digital money will need to evolve to meet demands and business models that have not yet been thought of,” he said.

Though there is certainly demand for a CBDC, a successful digital currency does face a number of challenges. Lovell’s blog post touched on the issue of privacy.

An intrinsic feature of cash is its anonymity. Research conducted by the OMFIF on the most important attributes of a CBDC found that the most ticked boxes were ‘privacy’ and ‘security’.

What lies ahead is for the BoE to consider how to allow a certain degree of privacy in electronic payments while ensuring compliance with regulations on combating financial crime.

“Digital currencies will need to find a different solution to this problem. The security scheme needs to be not only robust, but something that ordinary users can trust,” wrote Lovell.

Meanwhile, yesterday it was announced that the BoE would participate in research led by UK universities into hardware wallets for a possible tokenized CBDC.

Earlier this year, the Bank of England and HM Treasury created a task force on a UK CBDC.