Today Bank of America (BofA) announced it joined the Marco Polo blockchain trade finance network. Bank of America is one of the top four banks in the US with total assets of $2,396 billion at the end of June 2019.

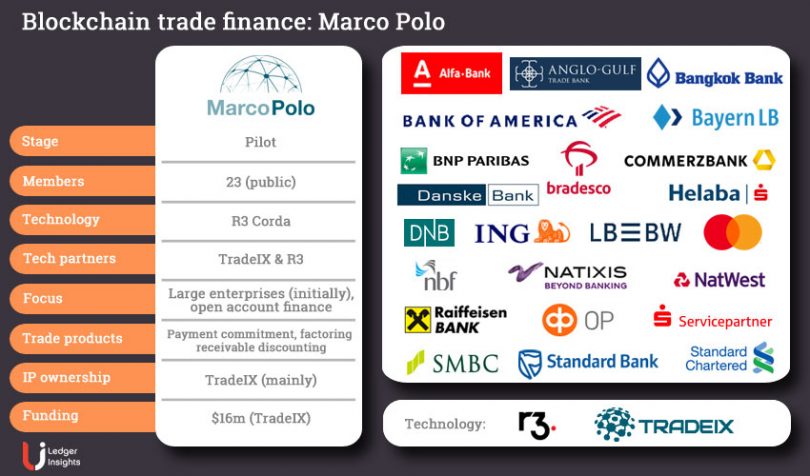

Marco Polo has some big names to boast of in its network, and BofA’s entry brings the total member count to 23. Other prominent members include Mastercard and top global banks such as BNP Paribas, ING and Standard Chartered.

“We look forward to exploring how the new technology (blockchain) can generate greater transparency for our clients throughout the transaction lifecycle, making traditionally paper-based, opaque processes easier and more efficient,” said Geoff Brady, Head of Global Trade & Supply Chain Finance in Global Transaction Services at BofA.

Bank of America owns 82 blockchain related patents. But despite this its Chief Operations and Technology Officer Cathy Bessant isn’t that bullish. She previously told CNBC “In my private scoreboard, in the closet, I am bearish.” She continued: “Spiritually, I want it to make us better, faster, cheaper, more transparent, more, you know, all of those things.” So for Marco Polo to win over Bank of America is indeed a major accomplishment.

Started in 2017, the Marco Polo network is in the pilot phase and offers open account solutions. Marco Polo’s blockchain platform provides members with risk mitigations solutions such as receivables discounting, payment commitment and payables finance programs.

One of the main features of the platform is ERP integration, which allows enterprises to get financing from multiple banks using a single dashboard. The company needs to select invoices, their choice of banks and the required funding amount. Current integrations include Microsoft Dynamics 365, Xero, and Oracle Netsuite.

Marco Polo’s blockchain platform is underpinned by R3’s Corda with TradeIX as the technology provider. A TradeIX executive previously said the platform is targeting large enterprises initially as they present a more significant revenue opportunity.

“The Marco Polo Network is accelerating its presence in North America and we are very pleased to have one of the largest and most innovative trade finance banks in the world joining the Network,” said Daniel Cotti, Managing Director, CoE, Banking & Trade for the Marco Polo Network.

Members of Marco Polo Network include Alfa Bank, Anglo Gulf Trade Bank, Bangkok Bank, Bayern LB, BNP Paribas, Bradesco, Commerzbank, Danske Bank, DNB, Helaba, ING, LBBW, Mastercard, National Bank of Fujairah, Natixis, Natwest, OP, Raiffeisen Bank, SMBC, S-Servicepartner, Standard Bank, and Standard Chartered.