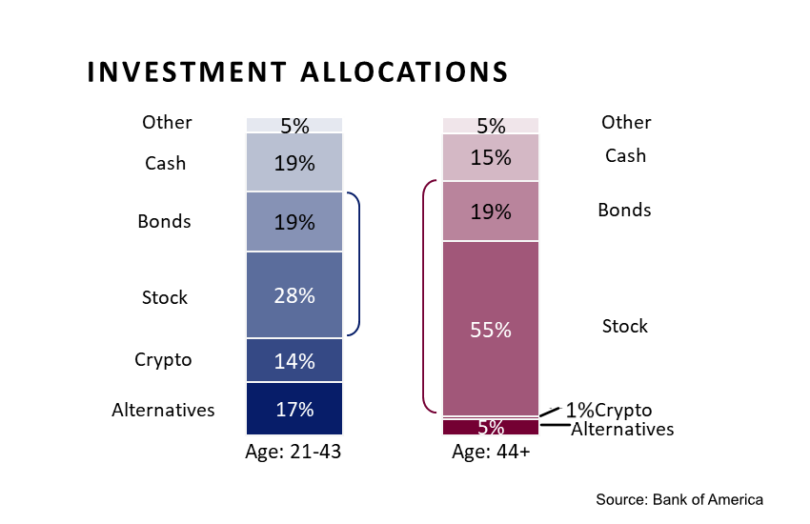

Bank of America’s survey of more than a thousand wealthy Americans found a significant shift away from investment in stocks by younger generations. This was also reflected in last year’s survey. While those aged 44 or older allocate 55% of their investments to stocks, for the younger age groups, the figure is almost half that (28%), with a far keener interest in cryptocurrencies (14% versus 1%) and alternatives (17% versus 5%).

The figures are particularly important because there’s expected to be an $84 trillion intergenerational wealth transfer through 2045. Around 42% of the transfers are expected from high net worth individuals (HNWI).

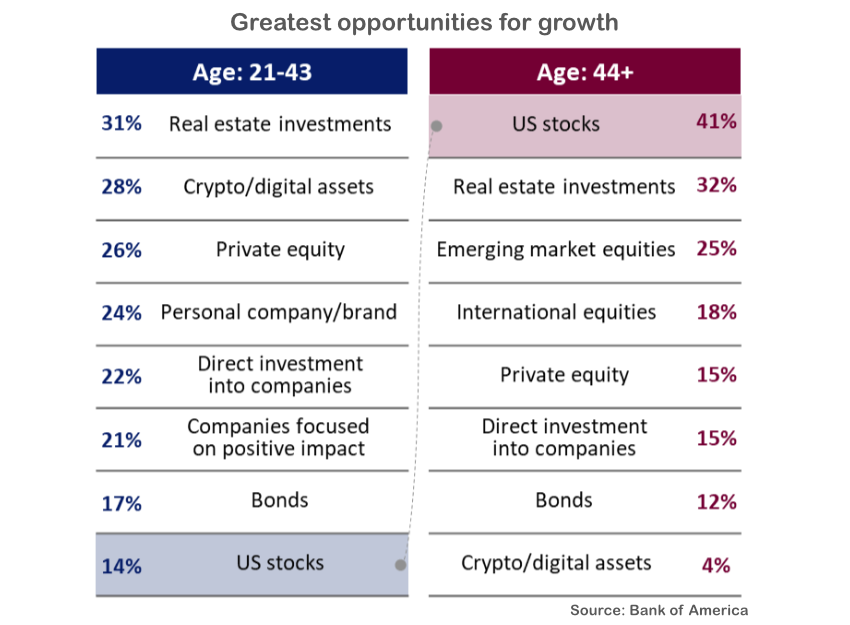

Looking at where the different generations see future growth prospects, stocks rank top for the older generations and bottom for the younger. While that might look bad for corporate investment, when you add up the investments in different types of companies (excluding personal companies), the figures are surprisingly similar at 57% for the younger group and 56% for the older.

The declining interest in stocks among younger generations could bea passing trend. If this trend continues, demand for listed stocks could significantly decrease in the coming decades. We’ve already seen a trend for very large unicorns staying private longer or in some cases that could become permanent.

Meanwhile, the interest in private equity is driving experiments in tokenizing private equity investments to make them more accessible to non-institutional accredited investors. So, while these findings are interesting, they reflect trends we’re already seeing – apart from the waning interest in listed stocks.