As part of its annual results announcement, the Australian Securities Exchange (ASX) revealed that it spent A$216 million ($150 million) to the end of June on the blockchain replacement of its CHESS settlement system. That figure covers all work since 2016 but does not include its investment in the software developer Digital Asset. The project is expected to launch at the end of 2024 at the earliest. (Update: the project has been ‘paused’).

ASX owns a 5.4% stake in Digital Asset worth A$34.6 million ($24m), which values the startup at US$443 million. The ASX said it carries the holding at fair value based on Digital Asset’s most recent funding. Japan’s SBI made a small investment in May. Before that, the startup raised $120 million in a Series D funding a year earlier, bringing its cumulate backing to $307 million.

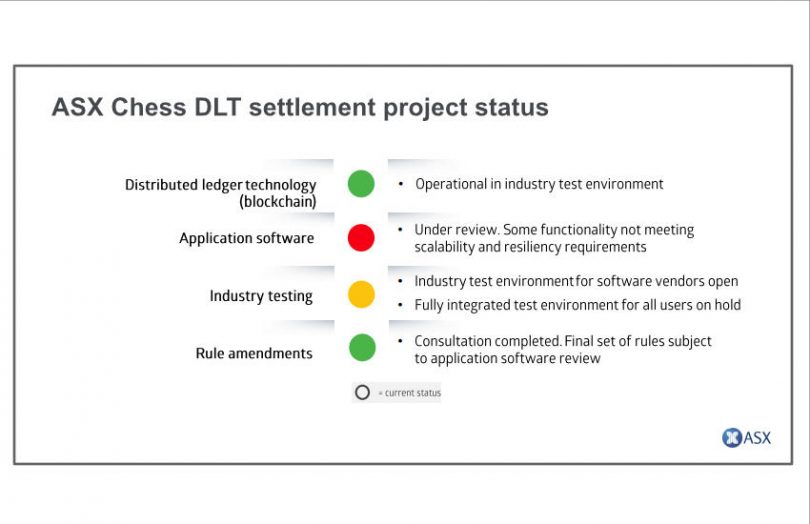

Digital Asset’s DAML smart contract language is used for the CHESS application with the VMware Blockchain providing the distributed ledger technology (DLT).

Accenture CHESS code review

Earlier this month, new ASX CEO Helen Lofthouse announced the latest CHESS launch delay and a new Accenture review of the application code. Today she clarified that its goal is to review areas of the application that present scalability and resiliency challenges, suggest solutions, and recommend a new timeline.

“I am disappointed that we’ve extended the timeline for go live for the third time. I know that our customers are disappointed too. But we are all in agreement that the system needs to be right,” said Lofthouse.

An analyst from JP Morgan asked whether there’s a risk of the project not completing and the size of that risk. Lofthouse was reluctant to comment until the completion of the Accenture review.

“But I would emhpasize that we have the distributed ledger technology and a really substantial amount of that software working in the test environment at the moment,” said Lofthouse. “And we do have customers and software vendors accessing that and using it and testing it.”

She continued, “The challenges we’ve communicated have really been some specific areas in the application code where we’re having challenges meeting the scalability and resilience requirements for the Australian market for the future. And that’s the specific areas we’re drilling into in the review. Beyond that, we’ll need to wait until the end of the review to figure out what that means in terms of a new timeline.”

Asked whether there’s a Plan B, Lofthouse emphasized that while the current CHESS system is working well, “it does absolutely need replaced. So we will be replacing it. This review is just working through some of the details of the challenges we’re having with the project.”

Talking more generally about technology work during the results announcement, Lofthouse said, “It’s important to note that the process of changing technology comes with its own risks. But the bigger risk is to do nothing.”