Yesterday, the Association of German Banks published its position on digital currency, saying a ‘crypto-based digital Euro’ should be launched. The entity is considered the ‘voice’ of private banks in the country, and now endorses a blockchain-based or inspired currency.

“The German private banks rate programmable digital money as an innovation with great potential that can be a key component in the next stage of the evolution of digitalization,” the statement reads. The group includes banks such as Commerzbank, Deutsche Bank, FinLeap, and UniCredit Bank among its 200+ members.

Citing the G7 report on stablecoins, the Association outlines how digital money is a requirement for automated internet of things (IoT) payments, customer convenience and cost, and to remain competitive. The banks believe that they, and other European entities, have the means to build and support the use of a digital Euro. But, they need institutional backing first.

“[We] expect lawmakers and regulators to lay the necessary foundations for digital innovation, especially in the banking sector,” stated the Association. Then, “The German private banks will play their part in establishing a sustainable, innovative monetary system. For this purpose, a programmable account and crypto-based digital euro should be created, and its interoperability with book money ensured.”

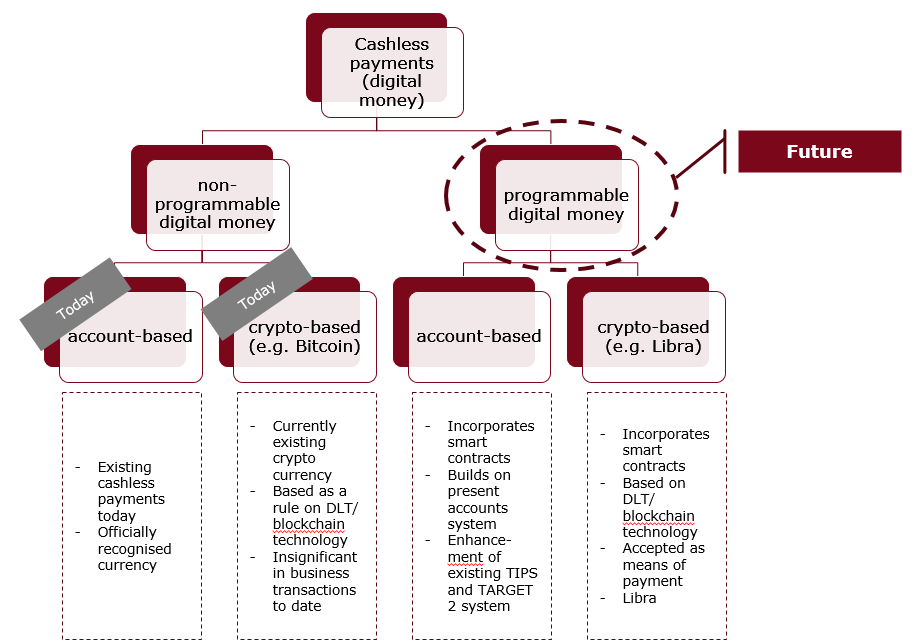

The entity has a detailed plan, with considerations of legal compliance, issuance, custody, and competition laws. It distinguishes ‘programmable’ money from cryptocurrencies, and account-based from (possibly, in the case of Libra) blockchain-based currency as pictured below.

Association of German Banks

The Association’s statement begins, predictably, with Libra. Monetary authorities will ban Facebook’s cryptocurrency project in Germany if it goes ahead. But that does not mean the nation or its private banks are non-supporters of blockchain. The German government released a blockchain strategy last month, sharing its endorsement of the technology and multiple ongoing projects.

In support of the national strategy, the Association agrees that there must be space for innovation. It quotes the strategy: “The government also rightly points out that the further development of blockchain requires “means of payment with a stable value in a blockchain environment” in order to “be able to carry out legal transactions on a delivery versus payment basis.” We believe a suitable technology-neutral legal framework is therefore needed to promote these and other innovations.”

The telling contrast between its desire for a digital Euro and the government’s suspicion of Libra comes down to data protection and know your customer (KYC) rules. The Association takes strong positions on the need for personal data protection and users to be clearly identifiable. Both points Libra has been criticized on.

The Association of German Banks is far from the first to ask for what is essentially a central bank digital currency (CBDC). It also mentions China’s currency project, which is well underway. This month, it was reported that the Bank of Canada was looking at a public CBDC to replace cash. The Swiss National Bank and Monetary Authority of Singapore are also working on digital versions of fiat money.