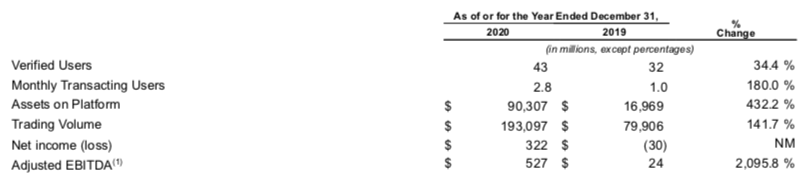

Today cryptocurrency exchange Coinbase filed information for a direct listing of a billion dollars on Nasdaq. The document shows a highly profitable 2020, and other very strong figures. However, Coinbase could have provided more useful data about its user base.

Strong figures

The company had topline revenues of $1.27 billion in 2020, up 140% from 2019, and it earned net income of $322 million compared to a $30 million loss in 2019. Its risk analysis highlights the volatility of cryptocurrencies which impacts its own revenues.

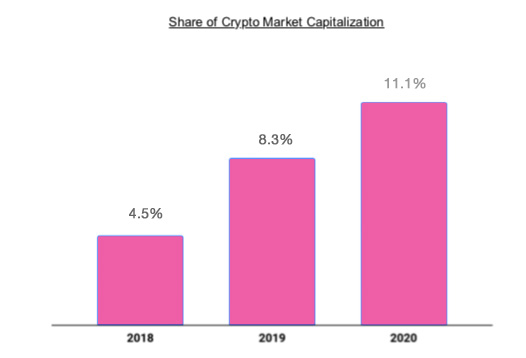

More impressive is Coinbase’s assets under management are a substantial share of total cryptocurrency assets. At the end of 2020, assets custodied represented 11.1% of the total cryptocurrency market and the proportion is climbing.

The missing metric

Coinbase disclosed some figures relating to users, but it could be more transparent. It says it has 43 million verified users. We’re not convinced that’s a useful figure given its definition: “Verified Users represent users who have demonstrated an interest in our platform”. There could be many users who never transfer money in and others from 2017 that never came back. Note Coinbase doesn’t show user numbers for 2017 below.

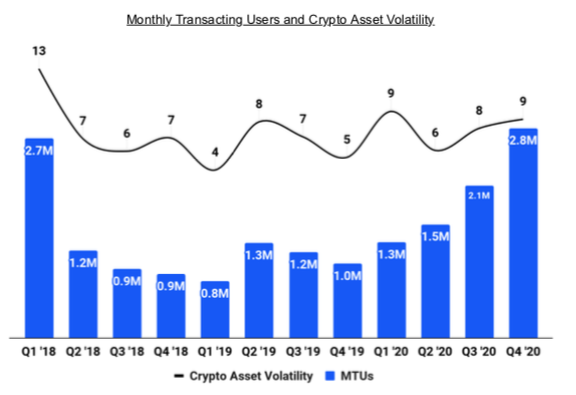

The crypto exchange disclosed the number of monthly transacting customers of 2.8 million. But given many cryptocurrency investors are known to ‘HODL’, a more useful metric would be the number of annual active users or the number of users represented by the $90 billion assets under management. Unless the user figure is a low priority because of the interest in institutions.

The $90 billion assets was at the end of 2020. Simplistically adjusting the figure for Bitcoin’s growth, all else equal, current assets would be around $160 billion.

This missing user figure is a critical metric to compare Coinbase to other firms. In its absence, the only figure we can use is the monthly active one.

Control and dilution

Coinbase has a dual class of shares, with Class B shareholders having 20 times the votes and there are far more Class B shares in issue.

As you’d expect for a pre IPO company, the shares are narrowly held. 61% of of the Class A and Class B stocks are each controlled by five groups, with seven key shareholders across the two classes. Andreessen Horowitz holds 14.2% of Class B shares and 24.6% of Class A shares and are by far the largest outside stockholders. In 2019 they bought stock from both Ribbit Capital and Union Square. CEO Brian Armstrong is the largest overall stockholder both in terms of equity and voting rights.

Other key shareholders in order are Union Square Ventures, co-founder Fred Ersham and his Paradigm Capital. Ribbit Capital which is also a major shareholder in Robinhood, owns 7.1% of Class B shares. And Tiger Capital owns 11.7% of Class A.

Valuation

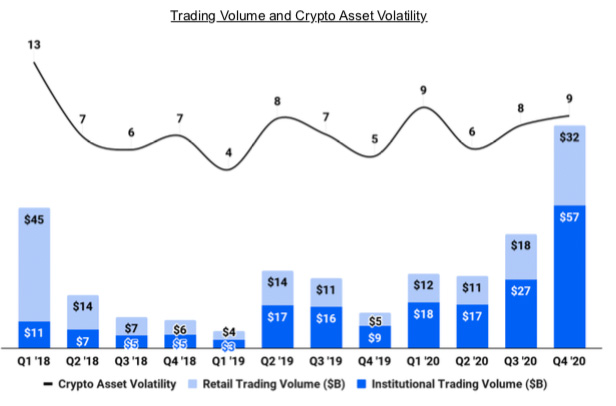

One of the big questions is how do you value Coinbase? We’d compare it to other brokerages. However, we’ve seen it compared to banks. How it’s classed might depend on the institutional versus retail usage. From the Coinbase graph below you can see a significant shift toward institutional investors and trading. Additional segmentation data would have been useful.

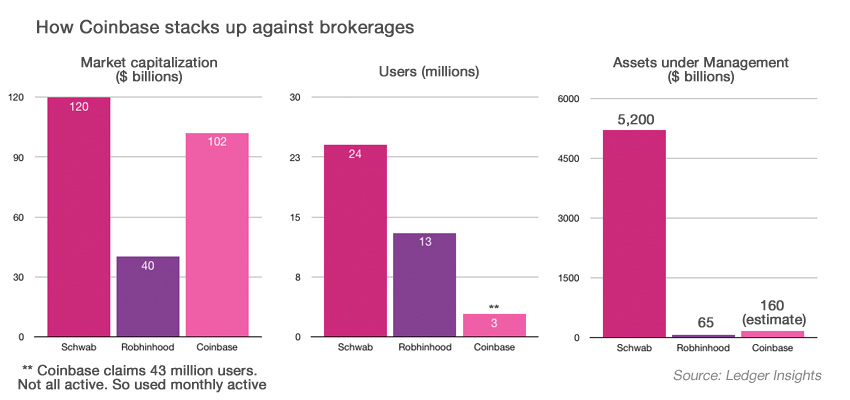

According to Axios, secondary market prices for Coinbase stock on private markets were $200 on Jan 29 and $373 on February 19. There will be 275 million shares in issue at listing, giving a market capitalization of $102 billion. In its last 2018 funding round, Coinbase was valued at $8 billion.

To compare Coinbase to brokerages, we’ve taken some liberties with the figures. Robinhood disclosed an average account size of 5,000 in recent congressional hearings, so we extrapolated that to $65 billion in assets under management. Quartz said Robinhood’s valuation was $40 billion in the very recent funding. For Schwab, we added user and asset under management figures from last year’s reports for Schwab and TD Ameritrade which have now merged.

Compared to Schwab, Coinbase is tiny in both user and asset numbers. Remember, we don’t believe the Coinbase 43 million user figure is ‘active’, so we used the 2.8 million monthly one in its absence. That’s likely an understatement which makes comparisons tricky.

Given growth prospects one would expect Coinbase to be more highly valued for assets and users, but the difference is pretty significant.

If you must compare Coinbase to banks, Goldman Sachs has a market cap of $113 billion compared to Coinbase’s potential $102 billion. Goldman had $2.1 trillion assets under management at the end of 2020.

Coinbase will also have a bit of a Tesla factor, as in Musk attracts stockholder ‘fans’. Likewise, cryptocurrency enthusiasts will add a premium to Coinbase’s price. Both have a bit of a blindspot. In the case of Tesla, other car manufacturers are catching up. And in Coinbase’s case, one can’t dismiss the risk of bans or major regulatory restrictions, nevermind custody and volatility risks.

Another key question is whether Coinbase has its timing right or whether the market has peaked.

Update: The key shareholder percentages were initially incorrect and have been fixed