Mercuria, one of the world’s largest energy and commodities traders, has ambitions to transform how the sector operates. To achieve its goal, it is setting up Mercuria Technology Ventures (MTV) to target investments in blockchain and AI companies. Together with other investors, it expects the funds available to reach $100 million in the near term.

The privately-owned firm had a gross turnover of $122 billion in 2018. Mercuria was founded in 2004 by Marco Dunand and Daniel Jaeggi, two ex-Goldman Sachs traders who are still significant shareholders. After acquiring the physical commodities unit of JP Morgan Chase in 2014, two years later, state-owned Chem China made a strategic investment.

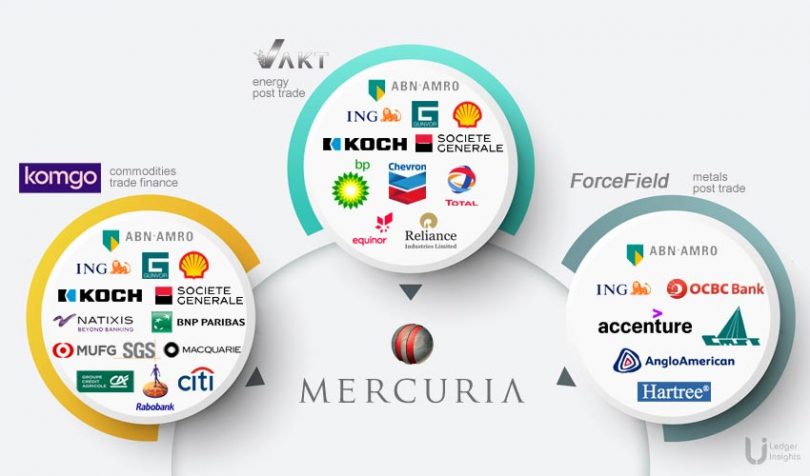

In the last two years, Mercuria has invested in three major consortia-style enterprise blockchain ventures. The first investment was in VAKT, the platform that enables the oil sector to function more efficiently by focusing on post-trade automation and reconciliation. VAKT already handles more than 90% of North Sea oil trades and is expanding into other energy markets.

Mercuria was a founding sponsor of VAKT which has a sister company, Geneva-based komgo, targeting commodities trade finance and in which Mercuria invested. And a more recent initiative is Forcefield, which also focuses on post-trade but this time for the metals sector.

When the existence of Forcefield initially leaked, the Financial Times included the London Metal Exchange as a participant, although it is not currently a member.

In the case of Forcefield, Mercuria is a founding sponsor and incorporated the firm in Singapore. In June the country established a Digital Industry Singapore Group to grow the technology industry. “We are currently in discussion with ESG [Enterprise Singapore] and EDB [Economic Development Board] to ensure that the right incentives are in place for Forcefield to flourish in Singapore,” said Mercuria’s group CIO Cyril Reol.

Reol is also a director for Mercuria Technology Ventures and sits on VAKT’s board.

Mercuria’s tech ambitions

Mercuria has long recognized the potentially disruptive impact of technology in the commodities sector. Hence it has been an early adopter, invested heavily and sees itself as a champion of change.

With a current firm-wide headcount of over 1,000 people, the technology team of more than 100-strong is a significant proportion. There are an additional hundred or so people who are not directly employed, and its tech hubs include Geneva, London, Bangalore, Houston, and Shanghai.

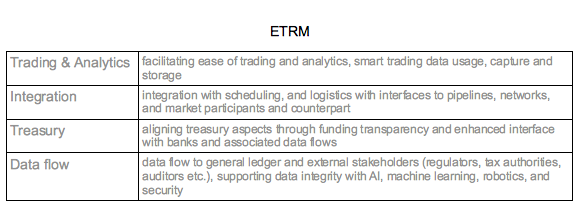

Ultimately the driving force behind the new venture fund is a vision of a new kind of Energy Trading Risk Management (“ETRM”) platform. The firm has already been overhauling its existing ETRM. But it aims to enable one that is automated and integrated with participants from the entire ecosystem. To achieve ETRM 2.0, Mercuria will continue its strategy of developing internally, co-developing and participating in joint ventures.

Reol says there are a series of new projects and joint ventures already in the pipeline.

Mercuria Technology Ventures

The planned investment fund won’t purely focus on distributed ledger technology (DLT). It will also aim to leverage the internet of things (IoT), machine learning and artificial intelligence (AI) throughout the commodities lifecycle.

“Our strategy of co-development and socializing efforts and benefits across the industry to encourage accelerate change and early adoption has proven to be effective,” said CIO Reol. “MTV will provide a structured framework to assess and invest in opportunities as a fit with Mercuria technical and business needs.”

A venture fund is not unfamiliar territory for Reol. Prior to joining Mercuria, he was CTO at asset manager Man Group which currently has $113 billion under management. There he executed several digital transformation initiatives. And before that he was group CIO at Glencore.

The ventures considered for Mercuria investment will be a mix of consortia-style firms like VAKT, komgo and Forcefield as well as standalone startups.

But the co-investors are likely to be similar to the consortia. “MTV is not a ‘standard’ private equity vehicle but the technology innovation arm of Mercuria Group,” Reol responded via email. “On that basis, we are focusing on the technology disruption opportunity for commodity trading and trade finance, therefore looking for similar investors.”

While no other details were mentioned, a quick look at the graphic shows several firms as co-investors in multiple ventures and ING and ABN Amro in all three. ING is perhaps the most prolific bank in the blockchain sector when it comes to investment. It has a stake in three of the four global blockchain trade finance initiatives. And it made a substantial investment in TradeIX, the technology firm behind the Marco Polo trade finance network. For its part, ABN Amro has a focus on trade as well as finance, and in particular integration and interoperability as part of the DELIVER consortium.

While MTV’s primary aim is to accelerate change in the commodities sector, let’s not forget that these equity positions also have profit potential. For example, in the case of VAKT, we estimated that the founding investors paid around $34 per share with post-launch investors paying close to $138 in December 2018.