Yesterday, market research firm International Data Corporation (IDC) forecast that China’s enterprise blockchain spending would hit $2 billion in 2023 as part of its Global Semi-annual Blockchain Spending Guidelines report.

The report was published soon after a flurry of blockchain activity was triggered by the speech of Chinese President Xi Jinping. Many saw the President’s endorsement of blockchain as a challenge to US dominance in technology.

“The biggest change in China’s blockchain market in 2019 is the leadership’s adjustment of blockchain technology, which has a huge impact on clarifying market awareness and promoting technology,” said Xue Yu, IDC China Blockchain Market Research Manager.

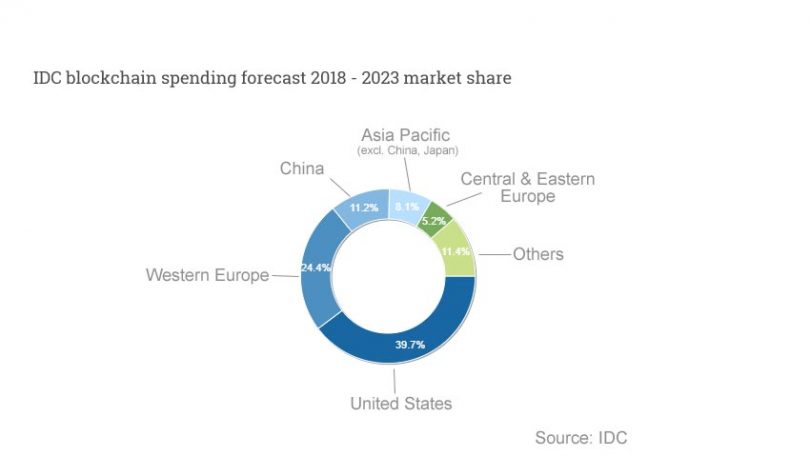

However, IDC forecasts that the US will lead blockchain investment globally through 2023 with a market share of over 39%, followed by Western Europe (24.4%), China (11.2%), Asia Pacific (8.1%, ex-China & Japan) and Central & Eastern Europe (5.2%).

On the industry front, the banking sector tops blockchain spending in China. Other leading industries to explore blockchain will be discrete manufacturing, retail, professional services and process manufacturing. These five industries account for 73% of the total expenditure forecast.

“Companies are confirming early blockchains, the value of the pilot projects and their readiness to officially put them into production,” said James Wester, Director of Global Blockchain Strategy Research at IDC. “The data in the Expenditure Guide shows that as companies increasingly understand the benefits of blockchain technology at the efficiency and process-promoting levels, the adoption rate and growth rate of the technology are accelerating,”

IDC sees trade finance and post-trade transactions as the most significant blockchain applications for China. This is followed by cross-border payments and settlement, product traceability, asset and cargo management, and regulatory compliance.

As of 2019, China’s blockchain expenditure stands at over $300 million. According to the report, blockchain spending in the country will grow at a compound annualized rate of 65.7% from 2018 to 2023.

Meanwhile, IT services and blockchain platform software account for over 74% of blockchain expenditure during the forecast period.

Other recent IDC blockchain forecasts and surveys include:

- IDC enterprise blockchain spending forecast (Aug 2019)

- IDC: 44% of European health providers never heard of blockchain (June 2019)

- Thales, IDC research reveals extensive US government blockchain adoption (May 2019)

- IDC: Trade finance took biggest slice of 2018 APAC blockchain spending (April 2019)

- IDC forecasts rapid enterprise blockchain spending growth (March 2019)

- IDC predicts huge blockchain impact on digital transformation by 2021 (Nov 2018)

- IDC blockchain spending predictions overshadowed by startups (July 2018)

Below are other recent blockchain surveys:

Accenture: blockchain for aerospace

Boston Consulting Group: blockchain for transport and logistics

Cap Gemini blockchain survey

Deloitte 2019 blockchain survey

Deloitte 2018 blockchain survey

EY blockchain (finance and tech professionals) survey

EY fintech adoption survey

EY APAC blockchain survey

IDC semi-annual enterprise blockchain forecast

IHS Markit survey

KPMG technology industry innovation survey

PwC blockchain survey

PwC China blockchain survey

World Energy Council / PwC blockchain survey

SAP blockchain survey

TD Bank payments industry survey

BNY Mellon payments survey

Friss insurance survey

Juniper enterprise blockchain survey

BIS Central Bank Digital Currency survey

IBM / OMFIF Central Bank Digital Currency survey 2018

IBM / OMFIF Central Bank Digital Currency survey 2019

ING general population cryptocurrency attitudes