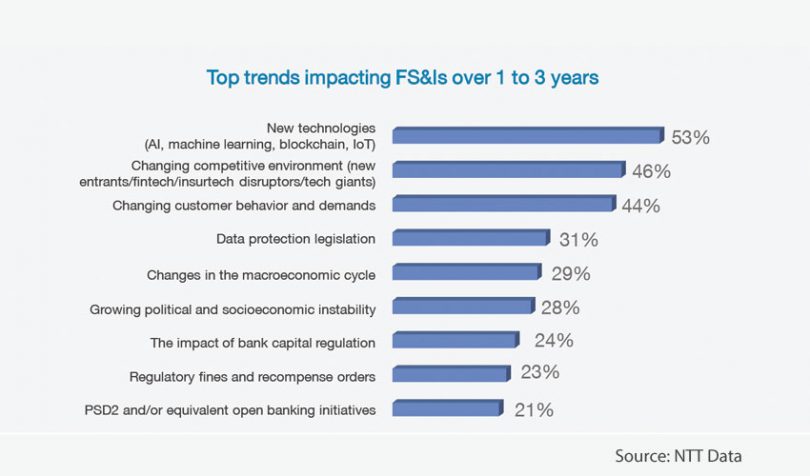

NTT Data recently surveyed 471 companies in financial services, including insurance. The impact of new technologies such as blockchain, AI, machine learning and IoT was the number one impacting trend cited by 53% of respondents.

The changing competitive environment closely followed that at 46%. Executives are seeing and anticipate new entrants from both fintech startups and technology giants. 83% believe that new entrants could become significant competitors.

Of the big tech companies, Amazon is seen as the biggest threat by a long way (65%) in all regions apart from Japan. That’s compared to Apple, Alibaba, Walmart, Facebook and Tencent. However, the survey only covered executives in the U.S., U.K., Germany, Spain, Italy and Japan. Also the executives were decision-makers, influencers or aware of budgets for Digital Business Platforms. So they may be biased towards tech.

78% say the list of financial services leaders will be very different within five years. Note that’s five years, not ten years.

Just three years ago, 7% viewed fintech as a threat and 15% planned to invest in modernization efforts. That compares to the recent survey when nine out of ten say now is the time for transformational digital change.

NTT Data’s research was focused on what it terms Digital Business Platforms (DBP). The existing tech giants have them, but it believes financial services companies can create their own.

In the opinion of NTT Data, DBPs can allow financial services companies to deploy new business models without gutting existing legacy systems.

In terms of those business models, the survey found that 61% are adopting new business models in response to a combination of new technologies, competitive threats and customer demand.

84% of financial services firms envision partnerships with fintechs and insurtechs. For distribution purposes, 66% imagine using fintechs, insurtechs and the platforms of large tech players like Amazon.

In terms of its own blockchain activities, NTT Data is helping numerous banks with the Italian banking association’s interbank reconciliation project.

It’s also working with Tokio marine and & Nichido Fire Insurance with a marine insurance blockchain project.

Below are recent blockchain surveys:

Accenture: blockchain for aerospace

Boston Consulting Group: blockchain for transport and logistics

Cap Gemini blockchain survey

Deloitte 2019 blockchain survey

Deloitte 2018 blockchain survey

EY blockchain (finance and tech professionals) survey

EY fintech adoption survey

EY APAC blockchain survey

IDC semi-annual enterprise blockchain forecast

IHS Markit survey

KPMG technology industry innovation survey

PwC blockchain survey

PwC China blockchain survey

World Energy Council / PwC blockchain survey

SAP blockchain survey

TD Bank payments industry survey

BNY Mellon payments survey

Friss insurance survey

Juniper enterprise blockchain survey

BIS Central Bank Digital Currency survey

IBM / OMFIF Central Bank Digital Currency survey

ING general population cryptocurrency attitudes