Bank of Communications (BoCom) Hong Kong is issuing a $300 million unsecured floating rate digital bond with a three year term. Given this is the Hong Kong branch of the state-owned Chinese bank, it may be the first digitally native bond for a Chinese bank. The issuance used the HSBC Orion digital asset platform and was cleared via CMU, the Hong Kong central securities depository with which Orion is integrated.

Moody’s gave the bond issuance a preliminary A2 rating, the same as similar conventional issuances and the Chinese bank’s long term deposit rating. That’s despite being state-owned, because Moody’s currently has a negative outlook on China’s sovereign rating. The bond is an unconditional, unsubordinated, and unsecured obligations of BoCom.

Any specific risks from using blockchain have been mitigated, in Moody’s view. That’s because HSBC Orion is a privately permissioned blockchain and the cash transactions are taking place off chain, for both initial settlement and coupon payments. Hence, payments would not be impacted by any platform outages. Moody’s noted that there are good business continuity arrangements for the platform and the CMU holds an off chain backup record of beneficial owners, which acts as the definitive legal record.

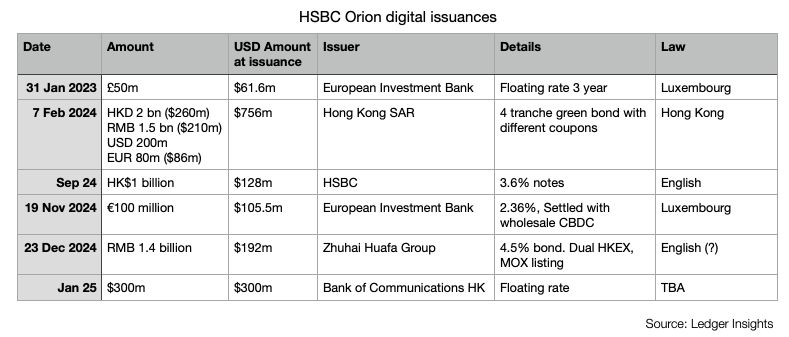

It also helps that the same platform has been used in several high profile bond issuances. Its largest was the $756 million four currency sovereign green bond for Hong Kong that was issued almost a year ago. With only two issuance in the first 13 months, activity ramped up late last year, with four bonds in the last five months. It helps that Hong Kong has a digital bond grant scheme that potentially covers half the issuance costs. But Singapore unveiled a similar program last week.

HSBC Orion uses Digital Asset’s Canton/DAML blockchain and smart contract technology as well as Hyperledger Fabric.