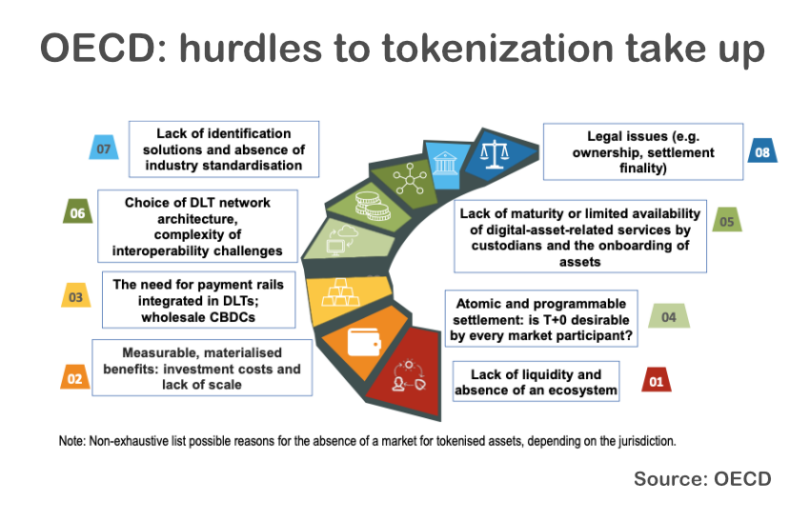

The Organisation for Economic Cooperation and Development (OECD) published a report exploring why tokenization hasn’t taken off faster. It briefly outlines the many potential benefits of tokenization including efficiency gains, improved securities settlement and the opportunities for innovation. It then explores the potential impediments to tokenization.

One challenge is the lack of a critical mass of investors, which makes issuers more reluctant to go down the tokenization route. In turn, that creates a lack of liquidity. The OECD noted that sovereign bond issuances can help, citing the Slovenia one.

We’d observe that quasi-sovereign issuers have been the most active, like the World Bank, the European Investment Bank (EIB) and various regions in Switzerland. Plus, the liquidity issue has often been addressed through integrations with conventional systems. However, the OECD highlights that if you’re integrating with conventional systems, then that cancels out some of the potential benefits.

Another challenge has been the chicken and egg situation of network effects. Until the network effect kicks in, the true benefits aren’t there yet, making the investment harder to justify. On top of that, many institutions already have ‘tech debt’ where they have outdated systems and don’t have budgets to adopt DLT.

What about the US absence?

The paper steps through the eight points shown in the diagram above. On the topic of custodians (or lack thereof) delaying adoption, we’d add a point not covered by the report.

Under the Biden administration, DLT and tokenization have been extremely hard, and sometimes impossible in the United States. A cornerstone has been SAB 121 which prevented regulated bank custodians from providing custody for crypto and also digital securities. That’s apart from the FDIC and other regulators that slowed or blocked bank participation in DLT projects. It’s notable that neither of the co-heads of JP Morgan’s Kinexys digital assets arm are based in the United States.

Given the United States has by far the largest capital markets in the world, that matters. For example, in October 2024, the market capitalization of the Nasdaq and NYSE were around $28 or $30 trillion each. The next largest markets are the Shanghai Stock Exchange ($7.2 trillion) and the Japan Exchange ($6.4 trillion). Without the United States, it’s like having a sports league with the largest teams not playing.

Tokenization friendly laws

Meanwhile, the OECD paper notes some potential legal challenges, but emphasized technology neutrality. While the report covered the progress of tokenization in Switzerland, it didn’t mention Japan or Germany, which we’d regard as amongst the most advanced economies when it comes to tokenization. These three countries have something important in common – legislation which is supportive and not entirely technology neutral.

While the neutrality principle is valid in many cases, sometimes a new technology can highlight the need for a legislative revisit. For example, both Germany and Luxembourg allow primary issuances without a central securities depositary (CSD) with a registrar taking on a lighter role. Notably, the EU legislative role of a CSD is still required for secondary markets, including in the EU’s DLT Pilot Regime. However, the DLT Pilot Regime does allow a trading venue and securities settlement venue to be one and the same entity.

Circling back to the Swiss example, when the SIX Digital Exchange (SDX) launched, SIX made it clear that it expected it to be a long, patient game, not a quick win. Some of the pieces of the puzzle are slowly falling into place, including the availability of cash on chain. Switzerland’s wCBDC trial was extended for two years. There’s the gradual launch of Fnality as a payment system in the UK, and the hope of some kind of central bank DLT settlement mechanism in the EU.