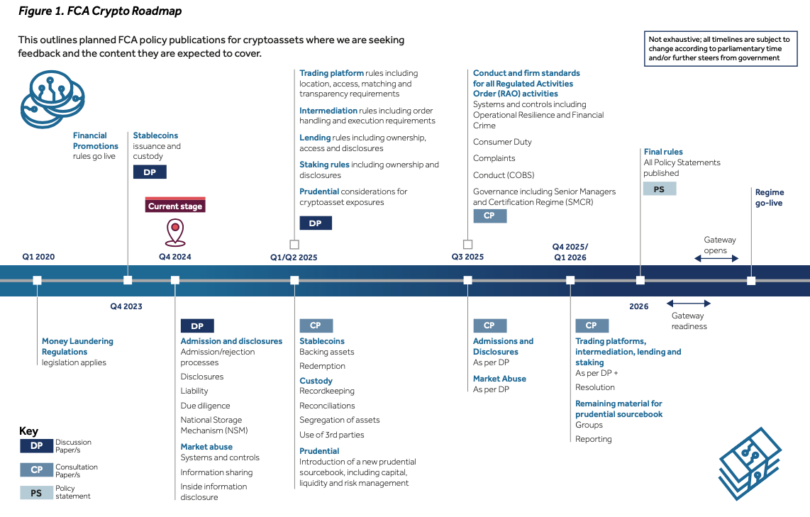

Today the UK’s Financial Conduct Authority (FCA) published a discussion paper on regimes for crypto-asset admissions and disclosures and market abuse regimes. It also reiterated the UK’s timetable for crypto legislation, targeting 2026. A key feature of the admission and disclosures regime is that public offerings of crypto assets will be banned, with two exceptions.

New public offerings of crypto-assets will only be allowed if via a regulated cryptocurrency exchange, or by restricting the offering to qualified investors. The aim is to put the onus on cryptocurrency exchanges to perform sufficient due diligence on offerings and to have a process for rejecting listings for trading. Exchanges may be subject to prudential requirements.

Legislation is needed because currently UK oversight of crypto only applies to anti money laundering and marketing.

Regarding the disclosures, the FCA is keen to avoid making it so extensive that it imposes disproportionate costs on the preparer. They also note that while consumers need comprehensive information, the quantity shouldn’t be so excessive that it obscures critical details. The paper provides a list of the expected contents.

The regulator is keen to encourage issuers to provide some forward looking statements. While these will carry some liability, it doesn’t want to set the bar too high. Hence, in the UK there’s a concept of protected forward looking statements (PFLS), where statements that turn out to be untrue only attract liability if the consumer can establish that the issuer knew the statement was untrue or reckless as to the facts.

The UK has a National Storage Mechanism (NSM), a free online repository of regulated information, including prospectuses from issuers. Information related to crypto-assets admitted to trading on crypto exchanges would be included in the NSM.

Preventing market abuse

Additionally, the paper covers steps to address market abuse. It recognizes that existing traditional market abuse regimes may not be as easy to implement for crypto because of market fragmentation, cross border elements, and in some cases, the lack of a clear issuer (such as Bitcoin).

Nonetheless, legislation will aim to prohibit insider dealing, require the disclosure of inside information by crypto exchanges and prohibit market manipulation. Inside information is sensitive information that could move crypto prices and hence needs to be disseminated as soon as possible to prevent a few people from taking advantage.

However, the listing of a crypto-asset without the issuer’s request can be problematic. The FCA hopes to address this by putting the onus on the entity requesting the crypto listing to make sure inside information is disseminated promptly. For traditional markets, the UK has a regulated information service, which is a centralized announcement service, and it is considering using this for crypto.

For the purposes of the paper, crypto assets include cryptocurrencies and stablecoins. However, a separate consultation is expected on fiat-referenced stablecoins in the future. There’s a three step process of discussion paper, followed by a consultation and then the final policy stance. The Bank of England and FCA issued a joint discussion paper on stablecoins in late 2023.