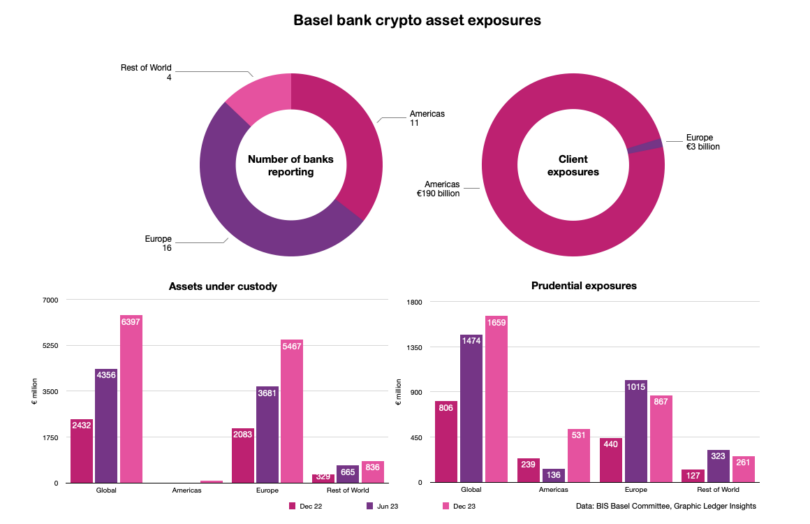

This week the Basel Committee on Banking Supervision published Basel III monitoring statistics for December 2023, including crypto-asset exposures. Given this was before the launch of US Bitcoin ETFs, the data is a little stale. However, they already show significant growth in American banks providing crypto services to clients. The statistics repeat the patterns of the previous period.

In particular, the Americas are almost entirely absent from the crypto custody space, largely because of the SEC’s SAB 121 accounting rule, which makes it prohibitive for banks to provide custody. That’s already relaxing and will likely be dropped altogether by the incoming Trump administration. In the second half of 2023, assets under custody in Europe grew by 49% to €5.5 billion ($5.8bn) compared to the first half. At a global level, 94% of custody was for spot crypto rather than tokenized assets or ETPs.

When it comes to enabling client exposures, the roles are completely reversed. The Americas dominate providing 98% of services. The figures are on a different scale, with American banks enabling €190 billion ($201 billion) of client exposures.

American banks also substantially increased their own exposures – by almost four times, albeit from a small base. 2023 year end prudential exposures amounted to €531 million.

While APAC is viewed as a promising growth sector, by the end of 2023 it still lagged far behind. However, the figures depend on which banks are included in the dataset. Of the four banks reporting in the ‘rest of world’ category, none reported any client crypto exposures. The banks’ own exposures were down 20% to a negligible €261 million with custody at €836 million. A lot of legislative changes have happened this year, so next year’s figures could be more interesting.

The statistics cover a total of 31 banks globally.