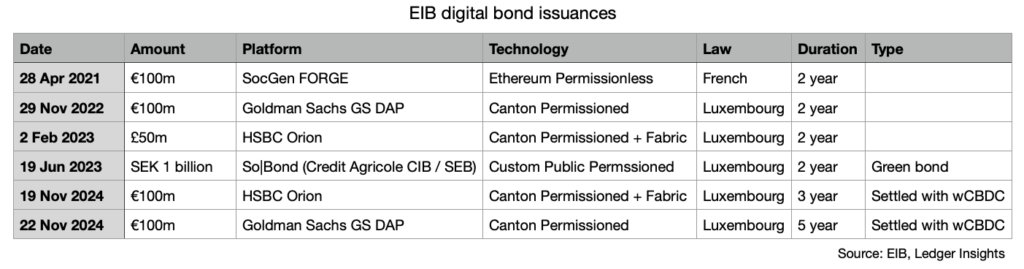

Last week we reported that the European Investment Bank (EIB) had issued its fifth digital bond. Just a few days later it issued its sixth, a €100 million issuance that also used the Banque de France’s ‘exploratory cash tokens’ or wholesale CBDC (wCBDC) for settlement. The sixth bond was also part of the European Central Bank’s (ECB’s) wholesale DLT settlement trials in central bank money which end this month.

A wCBDC enables the bond to settle atomically, using delivery versus payment. The Banque de France’s DL3S blockchain platform is the only one of the three ECB DLT settlement options that provides cash on chain.

Goldman Sachs provided its GS DAP as the tokenization platform for the issuance, with Goldman Sachs Bank Europe acting as joint lead manager alongside DZ Bank and LBBW.

“Our approach with this latest transaction was to provide investors with more direct access and to establish a structure well-positioned to support investors’ future activities for digital bonds, such as financings or collateral mobility use cases,” said Mathew McDermott, Global Head of Digital Assets, Goldman Sachs.

While Mr McDermott didn’t elaborate on the reference to collateral mobility, we’d note that BNY, the custodian and investor for this transaction, is a participant in collateral mobility platform HQLAᵡ alongside Goldman and many other institutions.

Goldman’s ambitions for GS DAP

Last week Goldman revealed it is planning to spin out GS DAP as an industry solution. GS DAP was used for a previous EIB digital bond issuance and for Hong Kong’s inaugural tokenized green bond.

“This iteration diversifies the testing of market issuance platforms, counterparties and custodial solutions, opening up new opportunities for institutional investors to access and test innovative financial solutions,” said Cyril Rousseau, Director General of Finance, EIB. “This issuance reflects our ongoing commitment to advancing financial technology and strengthening Europe’s market infrastructure.”

Clifford Chance advised the EIB and A&O Shearman the joint lead managers.

Meanwhile, some participants in the Eurosystem DLT settlement trials are pushing for the settlement solutions to be available for longer.