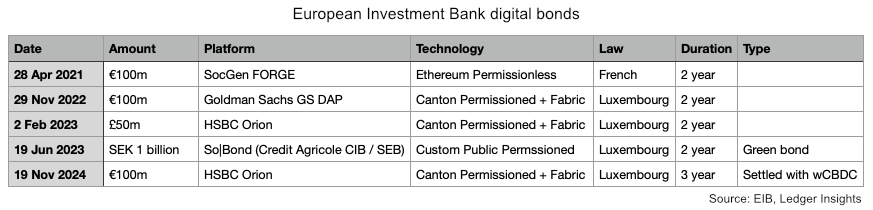

The European Investment Bank (EIB) has issued its fifth digital bond. It’s a €100 million issuance that will be settled tomorrow using the pilot Euro wholesale central bank digital currency (wCBDC) as part of the European Central Bank’s wholesale DLT settlement trials which end this month.

While we use the term wCBDC, the Banque de France refers to the tokens issued on its DL3S DLT platform as ‘exploratory cash tokens’. A key advantage of a wholesale CBDC is atomic settlement, which involves the simultaneous exchange of the cash and title to the tokenized security.

The EIB issued the latest digital bond on the HSBC Orion platform, the second time that the EIB has used it. The Banque Centrale du Luxembourg was the local central bank for the EIB.

Each of the EIB’s digital bonds has explored a new feature, often involving a different issuance platform. Its inaugural issuance was on the public Ethereum blockchain in 2021. The fourth one was a green bond, and the latest one used the novel settlement asset.

“As the European Investment Bank, we are proud to lead this effort, collaborating closely with the Eurosystem and demonstrating the potential of blockchain to enhance transparency, security, and efficiency,” said Cyril Rousseau, Director General of Finance, EIB.

“This bond underscores our commitment to exploring advanced digital solutions to increase Europe’s productivity and competitiveness and reinforce the Capital Markets Union.”

The joint lead managers for the latest bond were BNP Paribas, HSBC Continental Europe and NatWest Markets. Clifford Chance advised the EIB and A&O Shearman the joint lead managers.

Meanwhile, some participants in the Eurosystem DLT settlement trials using central bank money are pushing for and extension of the trials.