State Street Global Advisors (SSGA), the asset management arm of State Street, has published a report assessing the relative benefits of tokenization for different asset classes. SSGA has $4.4 trillion in assets under management.

It’s bullish on the concept of tokenization, noting that it can make markets “faster, cheaper, more transparent and more accessible.” However, it argues it will take time to realise the full benefits because it requires the creation of an entire ecosystem.

That build out will itself address many of the current barriers. Others frictions will fall away, including legal issues and bureaucracies such as old fashioned land registries.

However, SSGA highlights that some barriers will be more intractable. While there’s this vision of a massive global pool of retail investors, the reality is they live in different jurisdictions and must comply with AML and KYC, which could also be country specific. Additionally, access to certain asset classes, such as private equity and credit funds, will remain restricted because they are too high risk for the average investor to have significant exposure.

While we agree with those sentiments, there is a large pool of high net worth individuals. In fact, the authors credit a Bain & Co paper, which highlights the tiny proportion of alternative investments owned by individuals as opposed to institutions.

Which asset classes first?

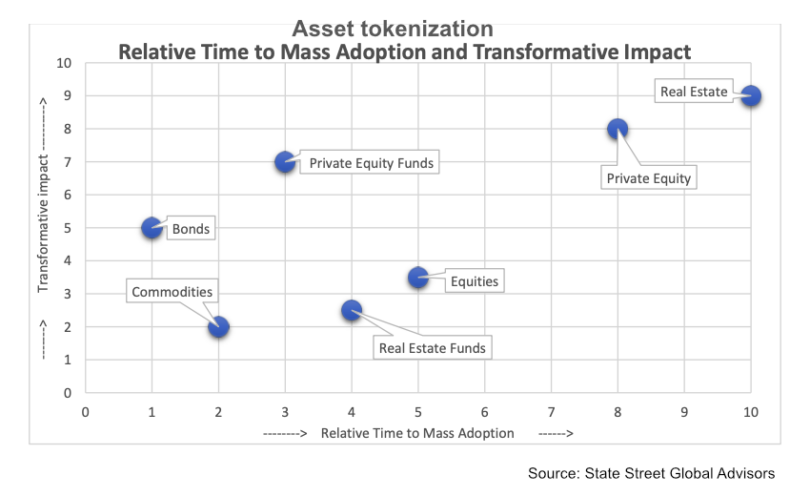

The authors explore several asset classes, including bonds, commodities, public equity, alternatives, and real estate. They didn’t commit to a timeframe for how long traction will take (the diagram’s X axis does not mention ‘years’). Instead, they plotted the relative progress they expect for each asset class.

Bonds are already the largest tokenized asset class and envisaged as the one with the most near term gains, followed by commodities, and private equity and credit funds.

The paper makes a valid point that many of the digital bond issuances to date have had alternative motivations beyond cost and speed. Sovereign issuers are keen to act as leaders and provide demonstrations. Financial institution issuers are getting a profile in a new competitive market. And some corporates such as Hitachi have other drivers such as sustainability.

We’d observe there have been rather few bond issuances by large enterprises. The most noteworthy issuer has been Siemens, which is also an early adopter of JP Morgan’s JPM Coin for DLT payments. One could argue that it too has an alternative motivation of wanting to be viewed as cutting edge.

Real estate

At the other end of the spectrum, the paper considers the tokenization of real estate. It sees the tokenization of real estate funds as likely to take off in the medium term, but subject to competition from existing real estate investment trusts (REITs). Because of this existing accessibility, it sees far lower relative benefits compared to alternative asset classes, such as private equity, where current access is very limited.

Regarding tokenization of individual residential properties, despite some existing projects, it envisages this taking the longest to reach scale. That’s in part because there’s a need to clarify the legal issues around fractional ownership of a house (although many current projects use companies or trusts). We’d add that real estate is an area where greater investor protections are needed, because it attracts scammers.

Meanwhile, the digital assets arm of State Street is gearing up for digital bonds and tokenizing money market funds as collateral.

We’ll add a link to the report when we receive it.