FX and payments fintech Neo conducted a survey of 100 European payment survey providers (PSPs), shedding a poor light on banks. Twenty nine percent of PSPs are reluctant to work with cryptocurrency exchanges owing to banking partner restrictions. However, given the increasing use of stablecoins for cross border payments, this “limits PSPs’ opportunities to participate in this growing sector, potentially affecting their capacity to innovate.”

According to the survey, PSPs are wary of getting on the wrong side of their banking partners. A full 95% have had banks close or restrict their accounts. One of the biggest complaints is the lack of transparency. 71% said their accounts had been closed or restricted without knowing why. 42% experienced closures or restrictions where the banks clarified the reason. The numbers total over 100% because it’s often happened with more than one bank.

For this reason, the vast majority of PSPs have multiple banking relationships with a mean of just under three. The majority, 55%, have two or three banks, with 30% having four or five.

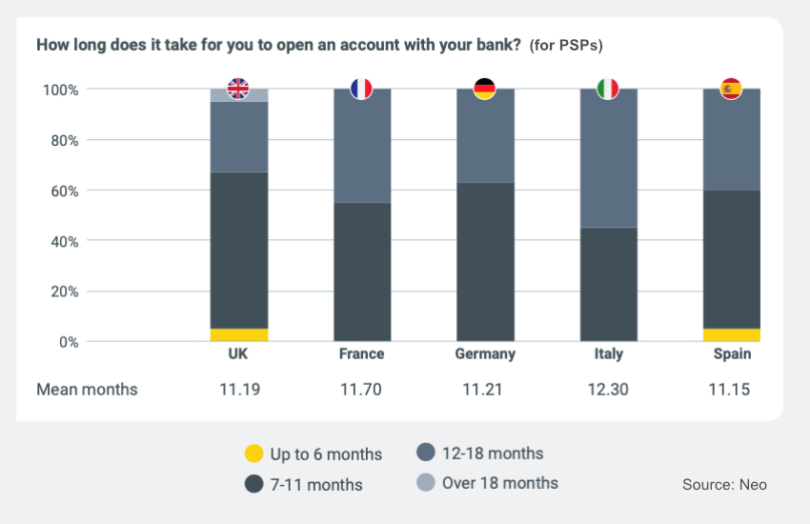

If they lose a banking partner, it takes a phenomenal amount of time to find a new one. Only 2% of PSPs have been able to open accounts in under six months. Most account openings take seven to 18 months, with a mean of 11.5 months. The UK seemed to have the biggest spectrum of time, including both the shortest and longest times.

The biggest banking headaches in order were:

- Lengthy onboarding processes

- Incompatibility with crypto exchanges, stablecoins

- Risk of account closure

- Legacy technology

- Poor support when payments are blocked

- Unclear risk appetite statements

- Restricted access to USD clearing.

There’s a caveat in that the survey was performed by Neo, which targets PSPs as clients. It provides FX and cross border payment solutions.