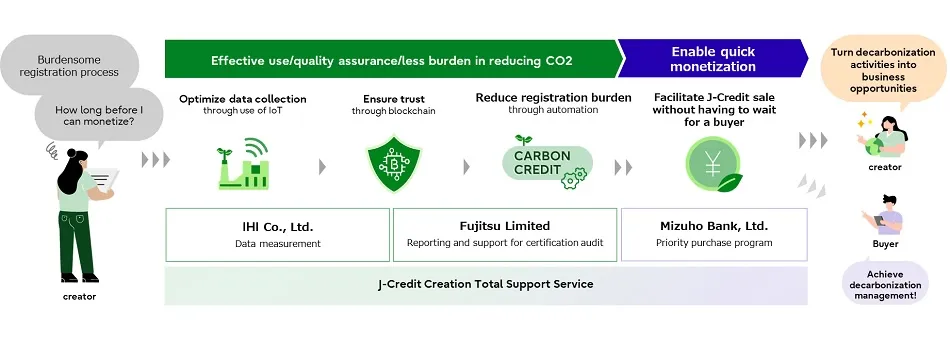

Three major Japanese companies, heavy industry firm IHI, Fujitsu and Mizuho Bank are collaborating to make the carbon credit issuance process less cumbersome with the help of blockchain.

In Japan carbon credit issuance takes place as J-Credits which require the government to certify the amount of greenhouse gas savings. Hence, it’s not a simple process to get the carbon credit issued. There’s a risk that, after taking the time to go through the process, the carbon credit issuer might struggle to find a buyer. Mizuho Bank is stepping in as a ‘priority purchaser’ to buy the J-Credits, which it will then sell to its clients.

The bank is a market maker for J-Credits on the Tokyo Stock Exchange, although the exchange volumes for J-Credits are quite small.

Together the companies plan to support solar panel power generation starting in the first half of 2025.

IHI and Fujitsu have previously collaborated on Fujitsu’s blockchain based solution for monitoring, reporting and verifying (MRV) the greenhouse gas emission savings. IHI has a solution using IoT to collect data. The partners say blockchain is used to ensure trust in the data, although we’d argue that it only helps to prove the data wasn’t manipulated later. Blockchain doesn’t help to verify that there was no tampering before logging the data.

Meanwhile, Fujitsu recently invested in DeCurret Holdings, the founder of the DCJPY tokenized deposit network that recently launched. The first DCJPY use case also has a sustainability theme.