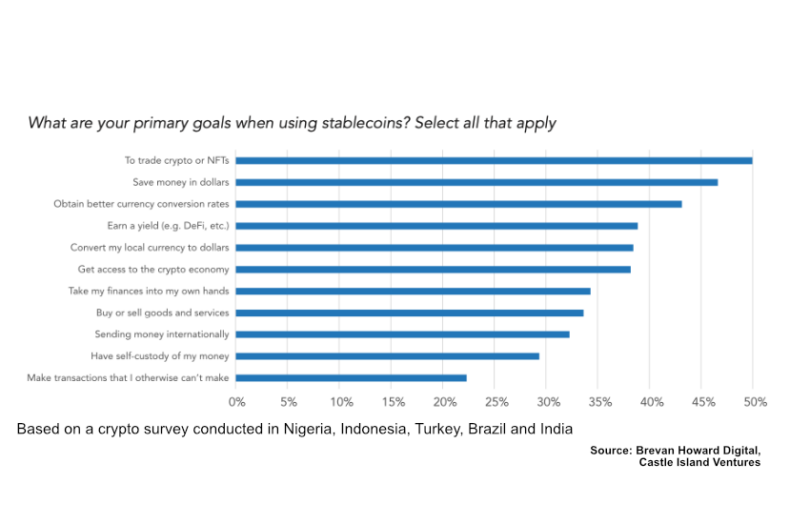

A YouGuv survey commissioned by Brevan Howard Digital and Castle Island Ventures aimed to explore stablecoin usage in five emerging market countries: Nigeria, Indonesia, Turkey, Brazil and India. It found that crypto is still the top use case for stablecoins (50%). However, access to dollars was a close second at 47%, with generating yield coming third (39%). The survey involved 500 existing crypto users in each country.

While there’s some anecdotal evidence of stablecoins being used to access dollars and for regular transactions, to date it’s been hard to pin down. In the survey, the desire to access dollars came through loud and clear. There’s definitely usage for cross border payments, but it only came in as the ninth biggest driver of stablecoin adoption, although 32% rated it as one of their primary goals.

Another set of questions aimed to probe non-crypto use cases by asking whether someone had done it at least once. Almost 40% of respondents had used stablecoins to pay for conventional goods or services, or for a cross border P2P payment. Thirty percent had used a stablecoin in their business and 23% had received or paid a salary at least once. We were keen to see which of these activities were regular ones.

Stablecoins and access to dollars

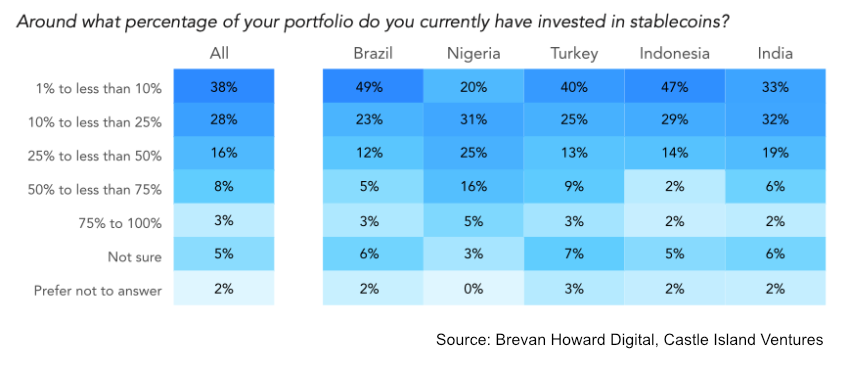

We briefly explore the topic of cross border stablecoin usage for financial inclusion in our report on bank stablecoins and tokenized deposits (see below). Because of that work, we were initially confused by the table below showing stablecoin holdings.

Nigeria’s relatively high stablecoin holdings made sense. But we wondered why Turkey wasn’t similar. Compared to the other countries in the survey, these countries have two things in common: they both have very weak currencies and exceptionally high remittance costs. We figured it out: the key difference is Turkish banks offer foreign currency accounts, hence dollar stablecoins compete with dollar bank accounts. Most Nigerians (and Africans more generally) don’t have that luxury.

Ledger Insights Research has published a report on bank-issued stablecoins and tokenized deposits featuring more than 70 projects. Find out more here.