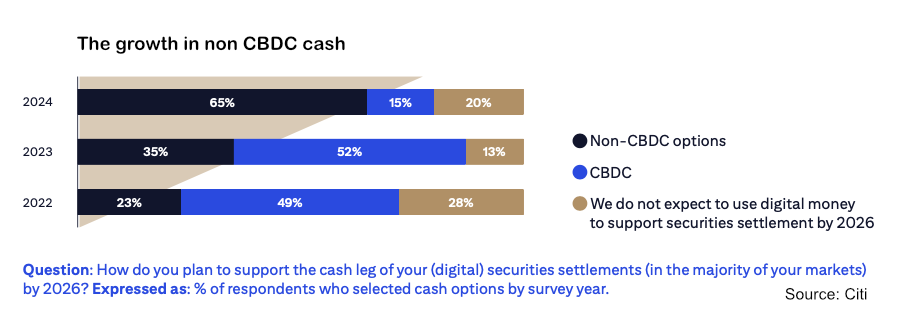

Today Citi published its latest Securities Services Evolution whitepaper. DLT and digital assets is one of three topics covered. A survey of almost 500 institutions found that there is less demand for using CBDC for digital asset settlement than in the past. Instead, there’s a greater emphasis on alternative digital payment methods including non bank stablecoins, tokenized deposits and tokenized money market funds.

The shift is quite significant. Last year 52% of respondents expressed a need for CBDC, but that figure dropped to 15% in the latest survey.

In the meantime, the European Central Bank has attracted more than 60 institutions to take part in its wholesale DLT settlement trials using central bank money. Although CBDC is one of three ECB settlement options.

However, Europe is one of the more advanced regions in terms of DLT progress.

Regional differences in digital asset progress

The survey highlights the degree to which regulatory headwinds have held back North American institutional involvement with digital assets. North America has the highest percentage of proofs of concept (30%) but zero commercial scale deployment. By contrast, 17% of Latin American and European respondents said they had live projects, with 12% in APAC.

The asset preferences also differ. In Europe the leading asset is cryptocurrencies (28%) followed by alternatives (22%), fixed income (20%) and private assets (17%). Fixed income is a low priority in North America. The asset preferences are alternatives (32%) followed by private assets (28%) and then cryptocurrencies (24%).

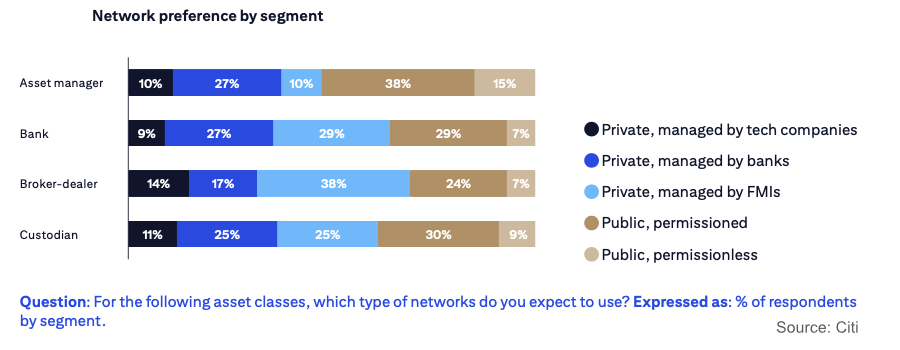

Public v private blockchains

With the Basel Committee for Banking Supervision (BCBS) discouraging banks from engaging with permissionless blockchain, the public-private blockchain debate is back on the agenda.

A Citi survey question on this topic shows the current preferences are private blockchains managed by financial market infrastructures (FMIs) such as central securities depositories, or public permissioned chains.

Notably, the Monetary Authority of Singapore has the GL1 initiative, which is exploring the creation of public permissioned layer one blockchain. Citi is a participant.

“The accelerating convergence of traditional and digital assets and operating models reinforces the need for modern platforms, reliable data, and real-time information,” said Amit Agarwal, Head of Custody, Securities Services, Citi. “We expect to see continued investments into automation, cloud infrastructure, and APIs as well as solutions that integrate with DLT networks.”

Ledger Insights Research has published a report on bank-issued stablecoins and tokenized deposits featuring more than 70 projects. Find out more here.