Today the BIS unveiled Project Rialto a new foreign exchange (FX) module looking to improve FX settlement for instant cross border payments. It will use wholesale central bank digital currencies (wholesale CBDC) as the settlement asset. The FX module could be used as an add on for solutions that interlink instant payment solutions, such as Project Nexus, or as part of a digital asset settlement solution.

Rialto is a collaboration between the BIS Innovation Hubs in Singapore and the Eurosystem. They haven’t yet shared which central banks are involved.

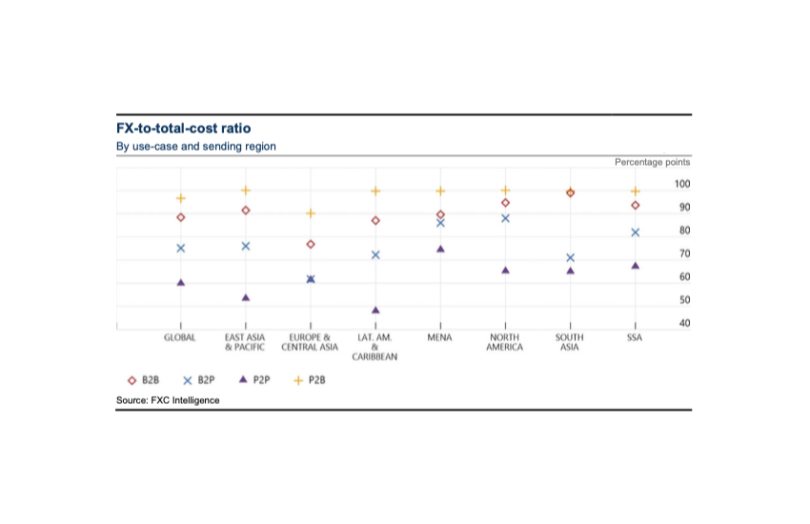

Given the G20 initiative to make cross-border payments cheaper and faster, the focus on FX is essential, given that it is the largest component of costs. As highlighted by the Financial Stability Board, FX accounts for 60% of P2P payment costs globally and as high as 97% of P2B payments.

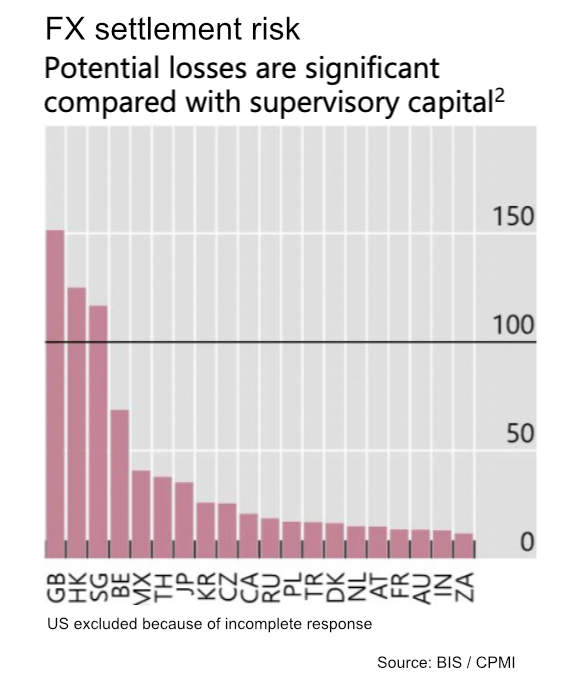

Moreover, FX settlement poses substantial risks, as evidenced by the fact that in three jurisdictions – the UK, Hong Kong, and Singapore – the FX settlement risk surpasses the total capital of banks in those regions.

Other FX projects

Rialto’s exploration of “decentralised solutions, CBDC and interlinked payment infrastructures” is not dissimilar to a previous BIS project, Mariana, involving the central banks of Singapore, France and Switzerland. It explored using DeFi automated market makers (AMM) for FX using public blockchain in conjunction with wholesale CBDC.

Additionally, as part of Singapore’s Project Guardian there have been multiple FX trials. They include FX prices streamed to a public blockchain in an initiative between Citi, T. Rowe Price and Fidelity. Another involved Onyx by JP Morgan, DBS and SBI Digital Asset Holdings using a decentralized exchange for FX. And a third involves BNY Mellon and OCBC using a bilateral blockchain linkage for FX to support 24/7 correspondent banking payments.

So far, the BIS has only made limited details about Rialto available. However, its modular nature could potentially make it usable for Project Agorá, the cross-border payment initiative involving the BIS and seven central banks.