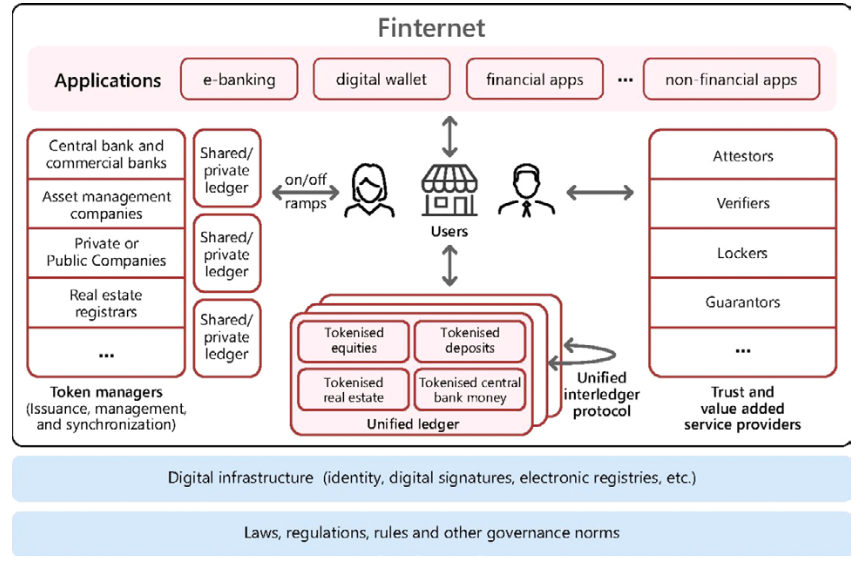

Today the BIS published a vision paper – the Finternet – that provides the North Star for its concept of a Unified Ledger based on tokenization. It notes that while digital identity, mobile and payment systems have brought enormous benefits, there are too few of these innovations in the financial sector.

“Large swathes of the financial system are stuck in the past,” say the authors Agustín Carstens and Nandan Nilekani. Mr. Carstens is the Head of the BIS, and Mr. Nilekani co-founded Infosys and led the government body that oversees India’s digital identity framework, Aadhar.

Last November Mr. Carstens issued a rallying cry to the public and private sectors to embrace innovation and Unified Ledger. The Finternet document complements that speech.

A Unified ledger brings together central bank digital currencies (CBDC), tokenized deposits and tokenized assets onto common platforms. There’s no plan for one massive ledger. Instead, there will be multiple unified ledgers. Tokenization reduces the need for messaging, cutting transaction delays, costs and reconciliations. By using smart contracts, programmability can enable automation, transforming the role of intermediaries to governance.

“According to our vision, individuals and businesses would be able to transfer any financial asset they like, in any amount, at any time, using any device, to anyone else, anywhere in the world,” the authors wrote. “Financial transactions would be cheap, secure and near-instantaneous. And they would be available to anyone, ensuring financial inclusion by meeting the needs of currently underserved segments of the population.”

Finternet vision – DREX but not public blockchain?

In some ways, this concept is familiar. We’ve heard something similar from two sources. One is Brazil’s concept of DREX, a wholesale CBDC solution where the CBDC and central bank DLT infrastructure provide the glue to enable private sector innovation. Rather than targeting wholesale transactions, its goal is to enable financial inclusion. It wants to cut costs and broaden accessibility to savings, credit and other financial instruments. The Finternet document outlines similar goals.

We’ve also heard of a similar vision from the public blockchain space, except the fundamentalist concept was to sidestep institutions such as central banks. The Unified Ledger embraces smart contracts and tokenization, but not particularly DLT. While Mr Carstens has previously stated DLT is possible, it would have to be permissioned. Like the Unified Ledger document, the Finternet paper makes no mention of DLT or blockchain.

As public blockchain has matured, permissioned applications have appeared on top of permissionless networks. And incumbents envision the public and permissioned DLT worlds converging. However, the BIS is considering something more centralized.

The authors are sanguine about the challenges that lie ahead including “coordination problems and vested interests”. However, they say the challenges should not encourage delay. “Rather, it increases the urgency to take the first steps by experimenting and exploring alternative approaches.”