Today Outlier Ventures published a thoughtful report on tokenization, ‘Beyond the hype of Real World Assets‘ (RWA). The authors believe industry estimates of a $10 – $15 trillion total addressable market (TAM) for tokenization by 2030 are on the low side.

They note that most estimates use a percentage of market values – such as the bond or real estate – based on current growth forecasts.

If there’s better price discovery enabled through tokenization, then the values of those assets will rise.

Additionally, they believe estimates overlook newly created assets and ‘segregation’, which can increase the value of an asset.

By segregation, they mean splitting an asset into different rights, which could mean the sum of the parts is worth more. An analogy is when conglomerates are divided to garner the actual values of the separate businesses.

We’d note that a recent example of this was a digital green bond issued by the Hong Kong Monetary Authority in 2022. Goldman Sachs was involved. The bond essentially had three valuable elements – the right to repayment, the right to receive coupons (interest), and the carbon benefits. The issuance separated the carbon benefits as tokenized ‘mitigation outcome interests’ (MOIs) described as carbon credit forwards. This supports separate trading of the two types of tokens.

Digitalization versus financialization

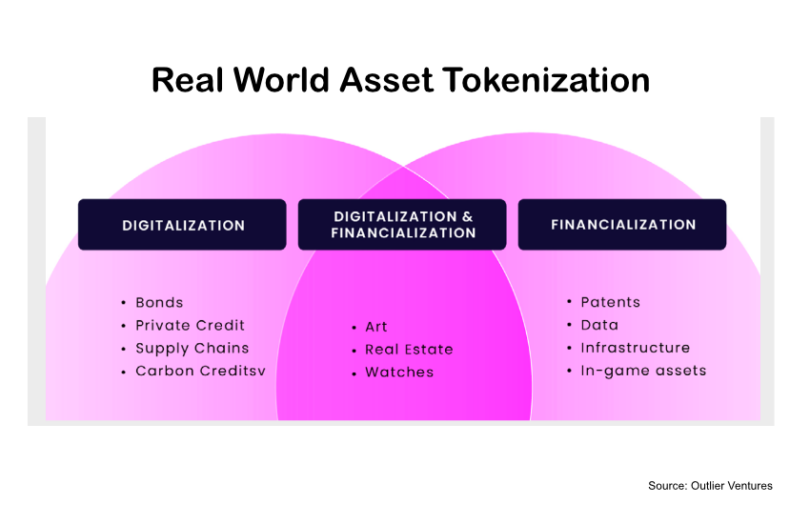

Another key theme of the report is the two drivers of tokenization are digitalization and financialization. And sometimes it is both.

Tokenizing a bond is an example of digitalization because the asset is already financialized. In contrast, conventional game assets may be tradeable, but web3 in-game assets are far more financialized.