An economics paper published by the European Central Bank (ECB) studies a situation where a central bank could experience a ‘bank run’ with a central bank digital currency (CBDC).

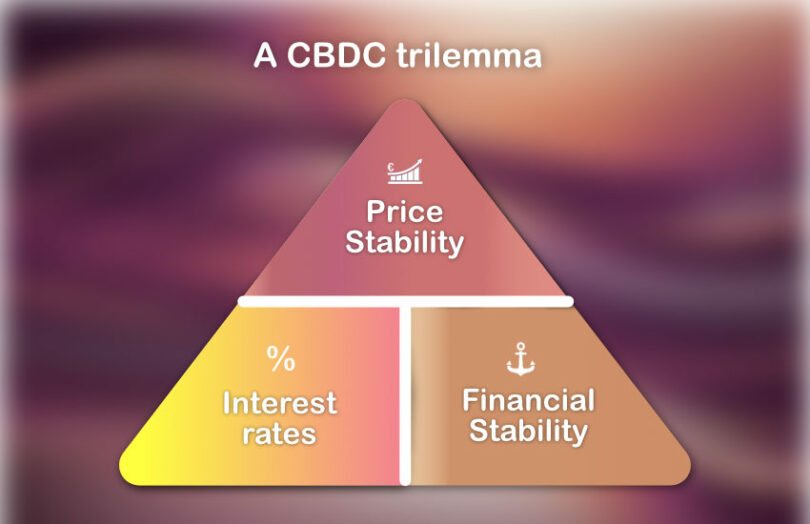

There’s a well known blockchain trilemma – the trade off between security, scalability and decentralization. The authors say that central banks face a different trilemma – between price stability, a socially efficient allocation (interest rates), and financial stability (no bank runs). Only two of these three are achievable.

Commercial bank runs result from the so-called maturity transformation of short term deposits into long term loans. Customers place their money on deposit but can often withdraw it on demand. Banks use these funds to grant mortgages and long term business loans. If too many depositors simultaneously ask for their money back, even healthy banks can get into trouble.

How a central bank could respond to a ‘bank run’

Now consider the same scenario but with a central bank. Either directly or indirectly, it also lends long. For example, in recent years the ECB has engaged in quantitative easing. And it may pursue a green investment policy in the future. On the other side of the balance sheet, if it issues a CBDC, this is similar to other types of bank deposits where consumer spending is unpredictable.

What if otherwise conservative consumers suddenly decide to go on a spending spree simultaneously or move their money out of the CBDC to get a more attractive return? The central bank has a card up its sleeve that commercial banks lack – it can just print money to pay back consumers. But in doing so, it sacrifices the objective of price stability.

If it wants to avoid inflation, another option is to increase the interest rates offered on the CBDC to make the returns more attractive. That should slow down mass withdrawals. However, apart from the run threat, raising interest rates may not be socially efficient for that point in the cycle. For example, raising interest rates is sub-optimal if an economy is emerging from a recession.

Assuming the central bank wants to keep inflation in check and hold interest rates, they have a third option. That’s for the central bank to perform a fire sale of its loans, which is likely to cause a stampede – a central bank run.

Hence the trilemma.

The paper’s findings don’t express the views of the ECB. In fact, the authors published another paper on the same topic through the NEBR three years ago.

Meanwhile, the ECB recently issued a vendor call for up to €1.1 billion in digital euro contracts, of which more than half is dedicated to an offline CBDC solution.