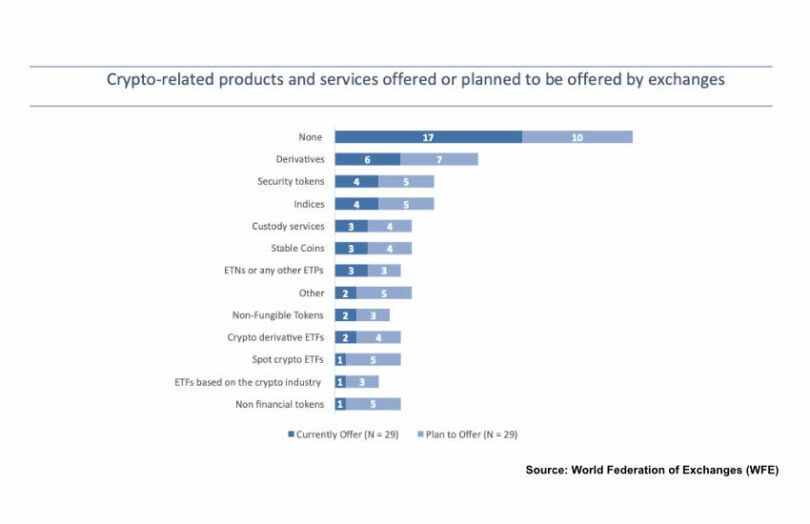

Today the World Federation of Exchanges (WFE) published its first of two reports on regulated commodities and stock exchanges engaging in cryptocurrencies. A survey with 29 respondents found that 12 are participating at some level, although only one provides direct exposure to pure cryptocurrencies such as ETH. The report also reviewed research around centralized (CEX) versus decentralized (DEX) crypto exchanges.

One survey finding was that regulated exchanges see the crypto sector as providing an opportunity to develop technology. The potential of a new revenue source ranked equally highly. And exchanges value the potential to broaden investor choice.

When asked about the perceived challenges in getting involved in crypto, every respondent mentioned regulation. That’s despite almost two thirds coming from the EMEA region, with the EU passing MiCA regulations. However, the WFE conducted the survey late last year, whereas MiCA received final approval this year.

Regarding other challenges, reputational risks and market infrastructure conditions ranked second and third.

Generally, there is greater retail demand for crypto services compared to institutional. Out of 12 categories, institutions only showed greater appetite in two areas: security tokens and a significantly higher demand for custody. Retail demand outstripped institutional interest by the widest margin for pure crypto categories such non-financial tokens (unbacked crypto), non-fungible tokens and stablecoins.

Centralized versus decentralized crypto exchanges

Turning to CEX and DEX comparisons, the paper outlined the key difference as central limit order books which centralized exchanges use, and the report said enjoy higher liquidity “in most cases”. The main reason DEXs use algorithmic automated market makers (AMM) combined with liquidity pools is to avoid the blockchain gas cost of updating order books.

Previous research shows transaction costs are higher on DEXs, particularly for smaller transactions. However, for the largest trade sizes of more than $1 million, the Uniswap DEX was cheaper for two out of six trading pairs.

Meanwhile, yesterday the London Stock Exchange stepped into the arena. It does not plan to offer cryptocurrency services but will use blockchain and tokenization for conventional assets.