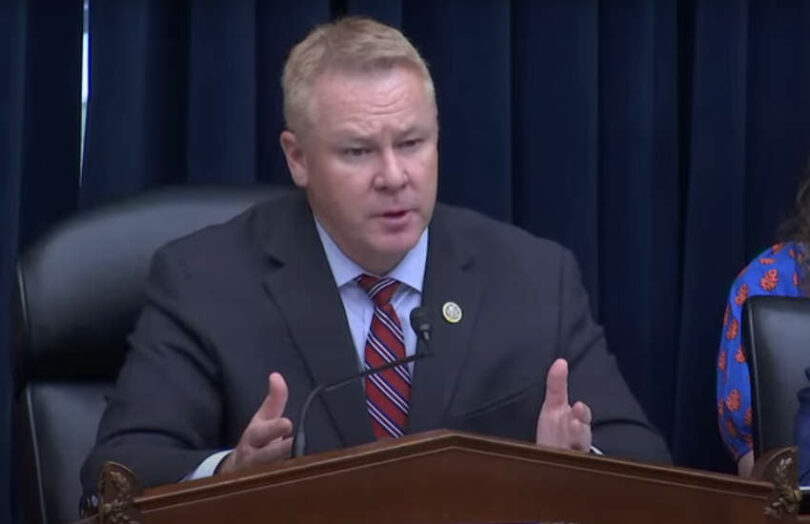

Yesterday, Republican Congressman Warren Davidson spoke out against developing a future digital dollar, saying “Central Bank Digital Currency (CBDC) corrupts money into a tool for coercion and control.” Like other Republicans, Mr. Davidson is strongly against programmability.

Anti-CBDC tweets

Davidson was reacting on Twitter to a CBDC job advertisement from the Federal Reserve Bank of San Francisco when he compared the development of a digital dollar to “the financial equivalent of the Death Star.”

One user responded that “necessary policies need to be implemented to ensure privacy and other consumer protection needs,” adding that the evolution toward smart programmable money should be welcomed.

However, Davidson disagreed. “Money should not be programmable by a central authority,” he said. “Money should be a stable store of value and an efficient means of exchange, not a tool for surveillance, coercion, and control.”

The Fed has stressed that CBDCs would be privacy-preserving. Often the intention of programmability is to allow users to send money at specific times. However, other central banks, such as the ECB, have explicitly stated that programmability – as in restricting usage for specific purposes – would not be allowed at the base layer.

Republican digital dollar concerns

Still, this is not the first time US Republicans have spoken against the idea of a digital dollar. Earlier this year, congressmen Emmer and Mooney introduced draft bills to curb efforts to issue (particularly a retail) CBDC, citing financial privacy concerns. The latter was endorsed by the National Association of Federally-Insured Credit Unions (NAFCU), a trade organization representing more than 180 members.

Florida’s Governor and GOP presidential candidate, Ron DeSantis, has also proposed anti-CBDC measures, as has Texas Senator Ted Cruz.

Overall, fears of government control, elimination of cash, and cyberattacks continue to weigh on many people’s views. A recent poll by YouGov and the Cato Institute found that twice as many Americans oppose the idea of a federally controlled digital dollar as those who support it.

Federal Reserve’s CBDC work

Despite all this, the Fed continues looking into a digital dollar. Its long-awaited position paper last year outlined several advantages but did not commit to formal issuance. As Chair Jerome Powel said in March, that decision is likely still years away.

In the meantime, state branches of the Federal Reserve have been moving forward. The Boston Fed completed Project Hamilton in December, while the New York Federal Reserve’s New York Innovation Center has been active in wholesale use cases and cross-border applications with the Monetary Authority of Singapore (MAS). It has also recently completed a digital currency trial with various banks related to the Regulated Liability Network (RLN).