Today The Financial Stability (FSB) published a report on Decentralized Finance (DeFi). It says that DeFi replicates traditional finance (TradFi), but it amplifies the risks. Given the FSB’s remit, its concerns include two stability areas in particular. One is the increasing linkages between TradFi and DeFi. And the second is the potential for a stablecoin failure to disrupt money markets if the reserve assets have to be liquidated quickly.

On the point of the TradFi and DeFi linkages, the report states, “the FSB will explore the growth of tokenisation of real assets as it could increase linkages between crypto-asset markets/DeFi, TradFi and the real economy.” One example is this week’s issuance of Siemens’ €60m bond on a public blockchain.

Enhanced risks from DeFi

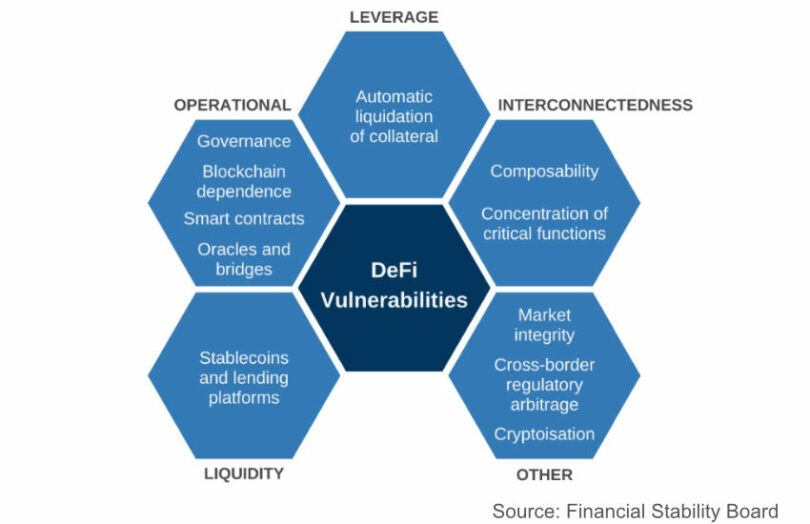

DeFi vulnerabilities include operational fragility, liquidity and maturity mismatches, leverage and interconnectedness.

On the operational fragility front, the FSB identifies governance of DeFi protocols and the dependence on blockchain networks that could become congested or, in cases such as Solana, unavailable for periods. It also mentions coding errors and cross-chain bridges, an area vulnerable to frequent hacks and losses within the past year.

The FSB views leverage as having an outsized impact on DeFi. That’s because smart contracts automatically liquidate collateral that can create a spiral. In contrast, TradeFi relies on central counterparties or market circuit breakers.

Potential bank exposure to DeFi

Banks could be exposed to DeFi either directly or indirectly. For example, on the indirect front, they might lend to a DeFi counterparty or a family office. That lending could be secured by real world assets or by crypto. Regulated institutions could provide market making, clearing services or derivatives for clients.

A direct bank exposure will materialize if they issue a bank deposit or settlement token used in DeFi. Or if real world assets are tokenized. There are numerous examples of tokenized bonds, of which a few are issued on public blockchains such as by the European Investment Bank.

A less obvious but real exposure is DeFi lending to banks. MakerDAO is an excellent example of this, as it has lent $100m to Huntingdon Valley Bank and $7m to Societe Generale in refinancing a covered bond.

The report states, “Should interlinkages of this kind grow, the risk that a shock originating in DeFi could be transmitted to the real economy would increase materially.”

However, the FSB isn’t just concerned about banks. It notes the increased activity of asset managers in the sector. For example, MakerDAO invested $400m in BlackRock ETFs. This is resulting in more permissioned DeFi protocols being created, encouraging greater institutional participation. “Such increased links may heighten the possibility of contagion, as investors are able to borrow in one system and invest the proceeds in the other,” says the report.

FSB DeFi plans

The report includes a number of recommendations. First off, the FSB plans to analyze the vulnerabilities of the DeFi ecosystem, as mentioned, including the potential for tokenization to increase TradFi-DeFi connectivity.

Secondly, together with standard-setting bodies, it wants the interconnectedness between DeFi, TradFi and the real economy to be measured and monitored.

Thirdly, proposed policy recommendations may need to be expanded to take account of DeFi specific risks. In particular, it wants to explore the regulatory perimeter, focusing on entry points that include stablecoins and centralized cryptocurrency exchanges.