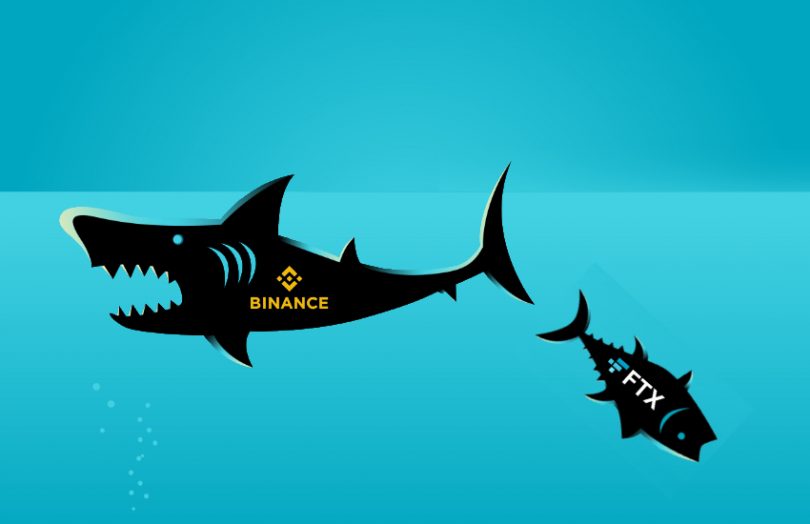

The Binance cryptocurrency exchange has withdrawn from its non-binding letter of intent to acquire FTX.com.

The exchanges statements reads, “As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com,” said Binance, which was also tweeted.

It was reported by the New York Times that FTX is looking to raise $8 billion to bail it out and has experienced withdrawals of $6 billion since Sunday.

The run on the FTX exchange started on Sunday when Binance’s CEO Changpeng Zhao (CZ) tweeted plans to sell its holdings of FTX’s token, FTT, and made comparisons to the LUNA/Terra crash. This followed a report by Coindesk last week that Alameda Research, the market-making firm owned by FTX CEO Sam Bankman-Fried, held $5.8 billion in FTT and FTT collateral.

After the deal announcement, CZ tweeted on Tuesday,

“1: Never use a token you created as collateral.

2: Don’t borrow if you run a crypto business. Don’t use capital “efficiently”. Have a large reserve.

Binance has never used BNB for collateral, and we have never taken on debt.”

One has to guess that by then, CZ had some data. If FTX’s balance sheet hole is due to the price of FTT tanking, then the Binance deal seemed to exacerbate issues. Between the start of the run and CZ’s acquisition tweet, the FTT price dropped from $23 to around $15 and stabilized. It partially recovered for a short time after the bail-out tweet. But after that, it sank to just above $4. That may have created a far more significant bail-out problem. Currently, the price is $2.65.

But the run doesn’t just have to relate to the FTT token. FTX.com was especially known for its derivatives and perpetual futures that offer significant leverage. To be able to provide leverage means the crypto exchange borrows money or has significant capital. Clearly, FTX did not have a significant capital buffer.

Some of the tweets of FTX CEO Bankman-Fried were deleted in the past few days. That includes one on Monday that stated, “FTX has enough to cover all client holdings. We don’t invest client assets (even in treasuries).”

From Binance’s perspective, it is already getting enough regulatory attention. If there’s a big investigation into FTX, and owns FTX, it doesn’t want the added attention. And the authorities would have the right to ask Binance a lot of questions.

Collateral damage

FTX was also a backer of the Solana blockchain. Apart from the FTT token, Solana is the biggest loser, dropping 50% in the past seven days. The second biggest drop is Dogecoin.

In related news, one of the FTX backers, Sequoia Capital, has already written its holdings down to zero.

And Silvergate Capital’s stock price is down more than 30% in a day. It’s the bank that acts as an on and off-ramp for many digital assets firms. There are concerns about potential loans it advanced which are backed by cryptocurrency tokens. However, if a big exchange has large cash balances drawn down at no notice, that could also have an impact. However, the Wall Street Journal quoted Silvergate’s President Ben Reynolds as saying, “FTX’s challenges have had no direct impact on the company.”

Update: a leaked FTX internal memo