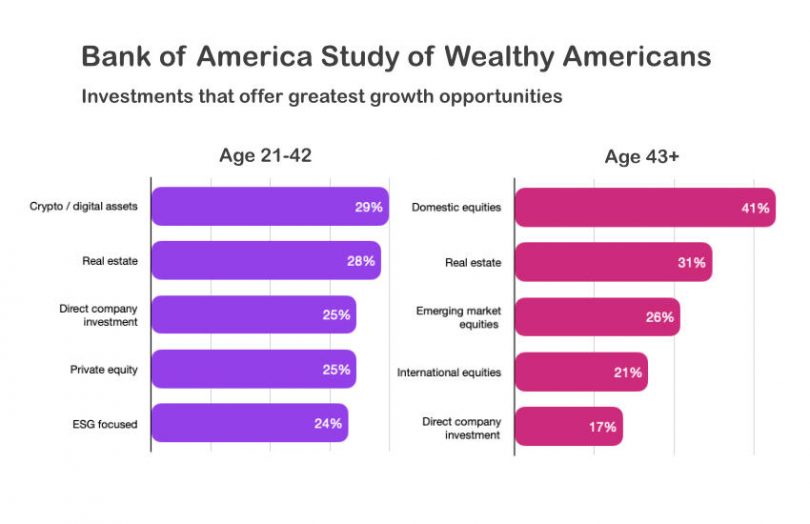

It’s widely known that cryptocurrencies appeal to younger audiences. However, the Bank of America survey of wealthy Americans conducted by its Private Bank found that younger generations are far less enamored by the stock market. Not only did digital assets feature in the top slot for growth opportunities for those aged 42 or less, but public stocks didn’t make it into the top five.

These statistics reinforce the repeated refrain at the SIBOS banking conference this week: banks are following customer demand, and retail customers are interested in cryptocurrencies.

Stocks make up a quarter of the portfolio of the 21-42 year olds, compared to 55% for their elders. These are all households with a minimum of $3m in investable assets.

However, the older generations and baby boomers in particular own the majority (62%) of the wealth, with 30% owned by Generation X, Millenial and Generation Z. But that has implications for public stocks as that massive wealth passes to the next generation over the next 20 years or so.

Despite the Bank of America’s fairly dramatic numbers, actions speak louder than words.

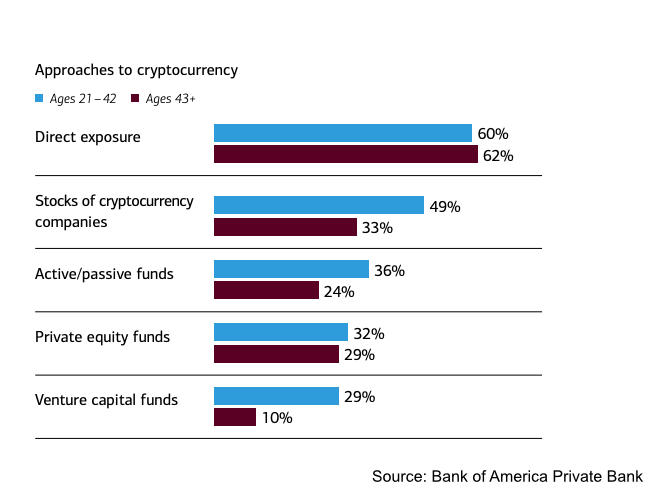

The younger age group is invested in crypto, but it makes up just 15% of their portfolio, compared to 2% of the older generations. And the proportion of the younger generation who believe crypto will become mainstream in three to five years was just 35%. Additionally, despite the low regard for the growth prospects of public stocks, they make up a quarter of their portfolio.

The future also bodes well for NFTs. Of the younger cohort, 59% said they own or have an interest in NFTs. This is reinforced by a greater interest in art, with two thirds owning an art collection compared to less than a quarter for the older group.