The Bank of Canada published a paper on retail central bank digital currencies (CBDC) exploring the type of storage, or what techies call the organization of state. Rather than a centralized versus blockchain comparison, it grouped the possibilities into five archetypes.

Five CBDC archetypes:

- Centralized

- Leaderless: eg. permissionless blockchain

- Macro partitioned: eg. enterprise blockchains

- Micro partitions: eg. MIT’s openCBDC and TODAQ

- Direct: cash-like P2P with tamper-resistant hardware

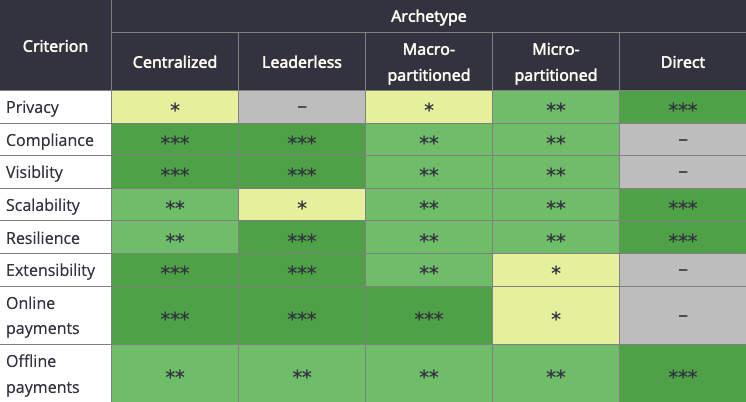

It then proceeds to rate each archetype according to design requirements such as privacy, compliance and scalability. However, it acknowledges that the detailed design could significantly impact these ratings.

How digital money is represented

While the state model is critical, so is how money is represented. In the permissionless blockchain world, Ethereum and Bitcoin are quite different. Ethereum uses an account-based model which is easy to follow. Bitcoin uses the unspent transaction output model (UTXO).

For UTXO, if you start with $100 and spend $20, the recipient ends up with a $20 token and you with an $80 token. As you spend money, your token will get smaller and smaller. That can also impact the overhead of the platform because there are many small tokens over time. It becomes like paying your grocery bill with coins.

In addition to account-based and UTXO, the paper also mentions the advantages of a bill-based model.

Finally, it notes that the account-based model might be easier for programmability.

The Bank of Canada was one of the central banks that started in-depth CBDC research long before Facebook announced Libra. It regularly publishes papers and also collaborates with universities. In March, it announced it was conducting research with MIT.

One of the biggest issues for Canada is the potential monetary sovereignty threat if the United States launches a digital dollar or if stablecoins are widely used for payment.