The Bank for International Settlements published a report on Basel III, the risk assessment framework, which has a new segment for crypto-asset reporting. Only 19 out of 182 banks reported crypto-asset exposures at the end of 2021, and two are purely crypto banks. The banks are unlikely to be the largest, as their combined assets represent just 2.4% of all the banks that reported. In terms of risk exposures, crypto-assets represented 0.01% of all exposures.

The total of all crypto exposures was €9.4 billion ($10.7bn at the end of 2021). In context, the total market capitalization of crypto at the end of last year was $2.7 trillion. In other words, banks accounted for much less than one percent of crypto-assets. That said, there have been some significant bank announcements during 2022.

And of those 19 banks that had some exposure, three made up two-thirds of the figures and the top six banks accounted for 92% of the crypto-assets. Unsurprisingly, almost 90% of the crypto-assets were invested either in Bitcoin or Ether, although via a variety of mediums such as direct, through Grayscale trusts and ETFs. Most of the rest of the crypto were the tokens of other layer 1 blockchain networks, although there were smaller amounts in the USDC stablecoin and tokenized assets.

American banks made up ten out of the 19 banks, with seven in Europe and the rest in Asia.

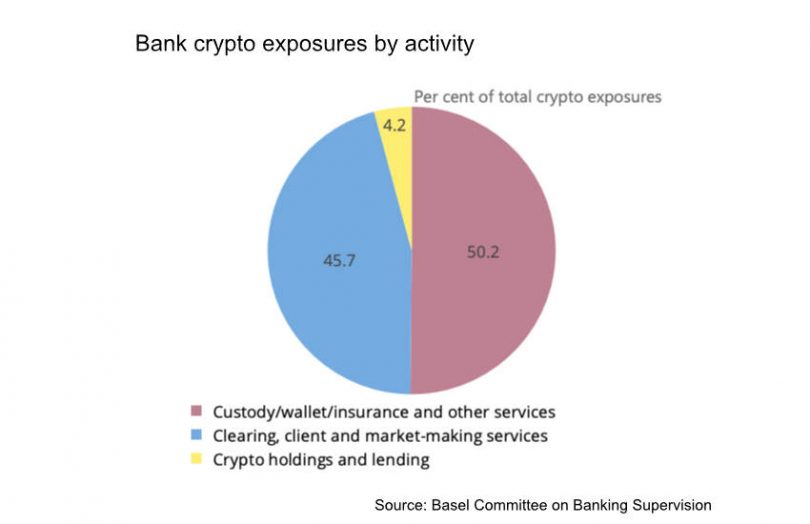

The top activities offered by banks were divided into:

- Custody/wallet/insurance and other services (50%)

- Clearing, client and market-making services (46%)

- Crypto holdings and lending (4%)

Basel III consultations re crypto

As previously reported, consultations on how to treat crypto-assets under the Basel rules have entered a second phase. The latest proposals added a DLT infrastructure risk of 2.5% for tokenized conventional assets. And the SEC went a step further by saying anything involving DLT should go on a bank’s balance sheet, which would include custody of tokenized real world assets. When a bank custodies conventional assets, they do not appear on the balance sheet. Last month it was reported some banks paused custody activities as a result.