Brands are using non-fungible tokens (NFTs) in a variety of ways. Many exploit their promotion and advertising potential. Some use them as a reward token and others – like sports clubs – sell NFT licensing rights. But for certain brands, especially those in the luxury and clothing sectors, NFTs could become a significant source of revenue in the future as the metaverse takes off.

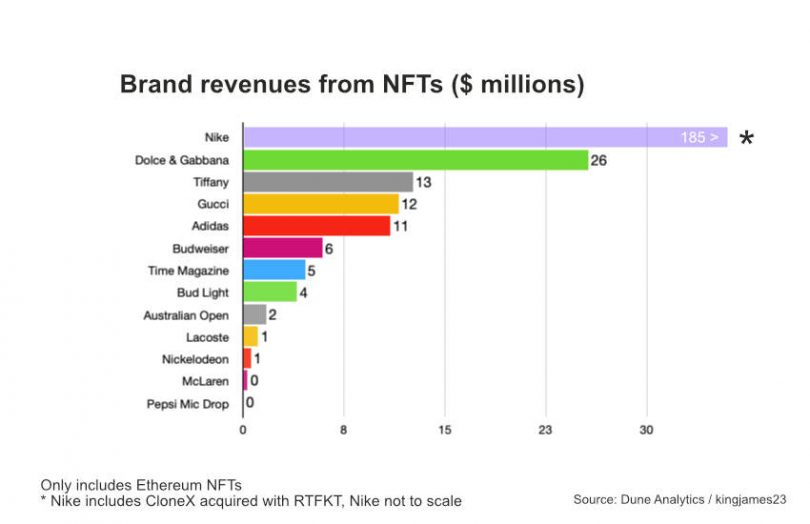

An NFT brand case study was recently released on crypto analytics site Dune, examining the performance of NFTs of large brands on the Ethereum network. In terms of total revenue, Nike tops the list at $185.32m, followed by Dolce & Gabbana and Tiffany at $25.65m and $12.62m, respectively.

The reason for Nike raking in far more than the other brands is its acquisition of the RTFKT NFT firm, which already had a track record and the CloneX collection, which accounts for more than 40% of Nike’s royalties.

Last year, Morgan Stanley research forecast that metaverse gaming and NFTs could account for 10% of the luxury sector’s addressable market by 2030, representing a €50 billion opportunity.

NFT revenues come from initial sales that go mainly to the brand itself and royalties representing a cut of secondary sales. In some cases, this may not account for splitting revenues with collection partners and or other associated costs like artist fees.

It is also worth noting that the breakdown of NFT minters across all brands skewed towards well-versed NFT users. The largest segment of users has performed between five and forty NFT transactions. Notably, 25.9% of Bud Light’s N3XT owners and 46.6% of Time Magazine NFT owners have track records of over 200 NFT transactions.

Furthermore, these factors do not account for technical mistakes, eating into the brand’s profit margin. Adidas launched an NFT collection in December 2021 but retained little of the $23m gross sales. Most of the revenues went to partners leaving $6.2m to adidas. The company had to reimburse users who were accidentally charged hundreds or thousands of dollars for Ethereum gas fees when NFTs failed to mint because of a glitch.

Ultimately, these revenue figures are minuscule relative to these companies’ global revenues. Even if unprofitable to begin with, these investments are arguably a small price to pay for forging their place in the metaverse and unlocking future critical revenue streams in the virtual world.