On Monday evening, the Terra UST stablecoin, which should be worth $1 lost its peg and sunk as low as 30 cents. It has yet to recover from its death spiral and currently stands at 56 cents on the dollar. As we’ll show, the crash should not come as a surprise.

Because an algorithmic stablecoin crashed, it’s important not to dismiss all other stablecoins, some of which can provide real utility for payments.

Algorithmic stablecoins are vulnerable to runs

Until April, the top three stablecoins, Tether, USDC and Binance USD were all asset-backed, not algorithmic. USDC and Binance USD are 100% backed by treasuries and bank balances, while Tether also holds a mix of other assets, such as commercial paper.

In contrast, Terra UST is algorithmic, using arbitrage to maintain a peg. UST works by burning the LUNA cryptocurrency to create UST when the UST price is too high or vice versa, burning UST to create LUNA when the price of UST is too low.

In April, UST overtook Binance USD becoming the third largest stablecoin, but lost that spot on Monday.

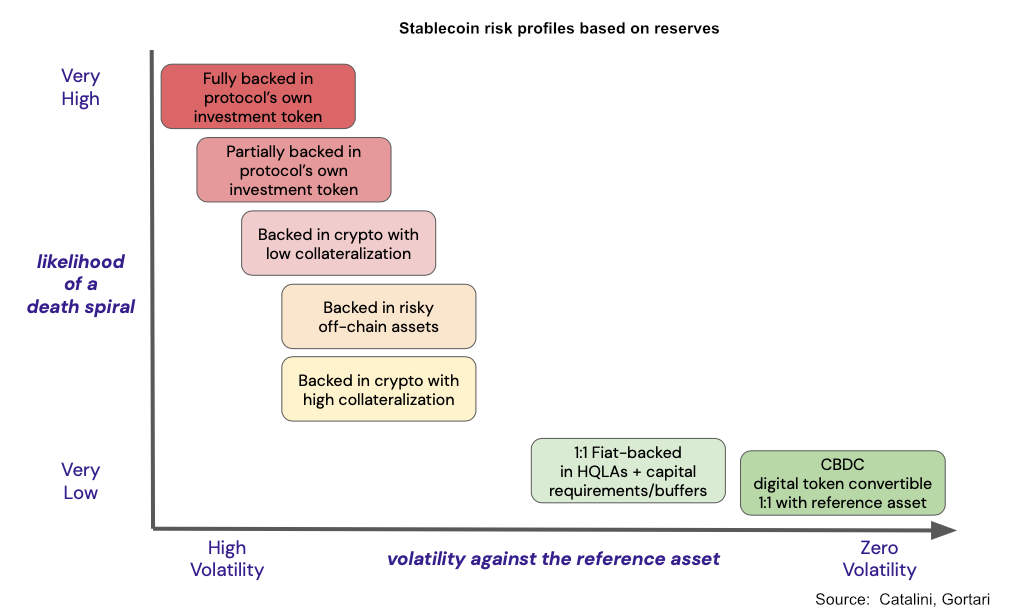

Christian Catalini, the former chief economist at the Diem stablecoin project, co-authored a paper last year which describes the likelihood of a death spiral for algorithmic stablecoins. “Algorithmic stablecoins are unlikely to be able to withstand extreme market conditions or a run on their reserves,” he wrote. The paper also briefly describes ways to attempt to fend off a run, the main one being to wind down the balance, which Terra Labs is trying right now.

Lesson: Algorithmic stablecoins are more prone to runs than other types, especially if they involve the protocol’s volatile token.

Six billion less stablecoins, ecosystem down $40bn+

The number of USTs in issue has declined from 18.6 billion to just over 12.6 billion at the moment, so the balance has been reduced by about a third.

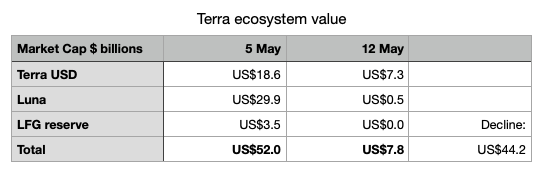

A week ago, the market capitalization of the UST stablecoin was $18.6 billion compared to today’s $7.3 billion. The larger loss in value is for LUNA token holders, where the market cap has dropped from $29.9 billion last week, to around $560 million now. However, many other tokens are down around 50% on the week, so the loss attributable to the stablecoin death spiral is not the entire amount.

Additionally, a Luna Foundation Guard (LFG) reserve was created partly as a backstop to have some assets to use for arbitrage in the case of a run. The LFG held $3.5 billion in Bitcoin a week ago and a much smaller amount of the Avalanche token, somewhere around $100 million. It’s not clear how much of that has been used.

Lesson: The potential loss to consumers is far more than the decline in the stablecoin’s value.

19.5% was too good to be true

Some DeFi lending protocols like Aave and Compound are two-sided crypto lending and borrowing markets where the interest rates offered are market-driven. The Anchor Protocol is the equivalent for the Luna/Terra blockchain but with an artificial deposit interest rate of up to 19.5%. This was a key driver in the expanding amount of the UST stablecoin issuance rather than any real utility.

In February, the Luna Foundation Guard gave the Anchor Protocol $450 million to continue to prop up the interest payments. Reference to Terra being a Ponzi escalated at this point, but both the UST market capitalization and the LUNA token price rose significantly after this grant.

The $450m grant proposal was made by Hashed, a Korean crypto venture fund that’s closely associated with Anchor and one of the biggest Terra/Luna validators (node operators). Hashed also has a crypto custody joint venture with Korea’s largest bank, KB Kookmin.

The responses to the $450 million grant proposal give a glimpse into the not-so decentralized decision making. One comment highlights a $450 million loan made by the Anchor protocol to a single wallet, which didn’t seem to be using the borrowed money but nonetheless paid a very high interest rate. The whale was described as “irrational or generous anonymous investors.”

Lesson: Too good to be true should set off alarm bells.

Using the associated stablecoin token for staking

Terra/Luna operates its own blockchain, based on the Cosmos / Tendermint protocols. As a proof of stake blockchain, people deposit tokens to help to secure the network. In order to ensure that a rapid withdrawal of staked tokens doesn’t impact the security of the network, there is a 21-day withdrawal delay. In other words, while the value of the token has been decimated, many were locked in staking, preventing the holders from liquidating.

On the one hand, one might argue that it’s genius because the decline in LUNA’s price would have been even more rapid if there had been no staking.

Lesson: Should a token used to stabilize an algorithmic stablecoin also be used for staking and securing a blockchain?

Interconnectedness is bad when there’s a run

Even though Luna Foundation Guard held mainly Bitcoin and only a small amount of the Avalanche (AVAX) token compared to AVAX’s market capitalization, the AVAX price has declined significantly more than other tokens: 61% in a week compared to Ethereum’s 37% and Polkadot’s 52%. AVAX experienced the largest fall in the top 20 coins, apart from LUNA.

Terra’s crash has been blamed as a key contributor to the steep decline across all crypto-assets in the last few days.

One of blockchain’s key advantages is composability, or the ability for smart contracts to depend on other smart contracts. So far, there hasn’t been evidence of this contributing to the free fall.

Lesson: Contagion is at least as big a risk in crypto as in the rest of finance, probably more so.

Lack of transparency and pseudonymity

Blockchain is meant to be known for its transparency. But cryptocurrency exchanges are opaque. It’s been reported that much of the LFG Bitcoin intended to stabilize UST has been moved to crypto exchanges, making it ready for use. However, there’s no clarity about whether or not it has been used.

Perhaps there’s still some Bitcoin left for stabilization, but we don’t know.

Coindesk also reported that Terra Lab’s founder Do Kwon, using a pseudonymous name, was behind another algorithmic stablecoin, Basis Cash, which is now only worth a penny rather than a dollar. Track records matter, especially in finance.

Lesson: People who have fiduciary responsibility for other people’s money should not be pseudonymous and should be vetted.

Get out before the stampede

Various theories are circulating about whales deliberately triggering a crash. What is clear is that some saw it coming early. The UST stablecoin dropped below 99 cents at around 5 pm UTC on Monday May 9.

However, volumes started to pick up at 11 pm on May 7. And the UST value dropped below 99.5 cents just after 2 am on May 8.

We received this statement from OKX, one of the top five cryptocurrency exchanges. “OKX risk management system noticed the price volatility of $LUNA and $UST in Anchor Protocol and redeemed the principal and pool rewards for OKX users on May 8, 2022, 2 am UTC before the depeg occured. Users were notified immediately.”

An OKX tweet indicates that it was the drop in price of LUNA below $65 that triggered the liquidation. This looks like a prudent move from OKX. But it would also have contributed to the run.

Lesson: Risk management matters.

The desire for algorithmic stablecoins will persist

Despite the clear risks, the cryptocurrency community is likely to continue to pursue algorithmic stablecoins. Or, at the very least, crypto-backed stablecoins such as the DAI. This is because fiat asset-backed stablecoins are inherently centralized and the increasing distrust of centralized institutions.

The march towards central bank digital currencies (CBDCs) could increase this motivation. While CBDCs can provide far greater security, they don’t offer the anonymity of cash. The argument that only criminal elements prefer anonymity is deeply flawed. History has seen despots come to power worldwide, and it’s hard to believe they won’t leverage CBDCs. Sure, some CBDCs will be designed to allow anonymity for low value payments. But that’s not the same as cash.

Lesson: Despite this fiasco, expect the continued pursuit of decentralized stablecoins.