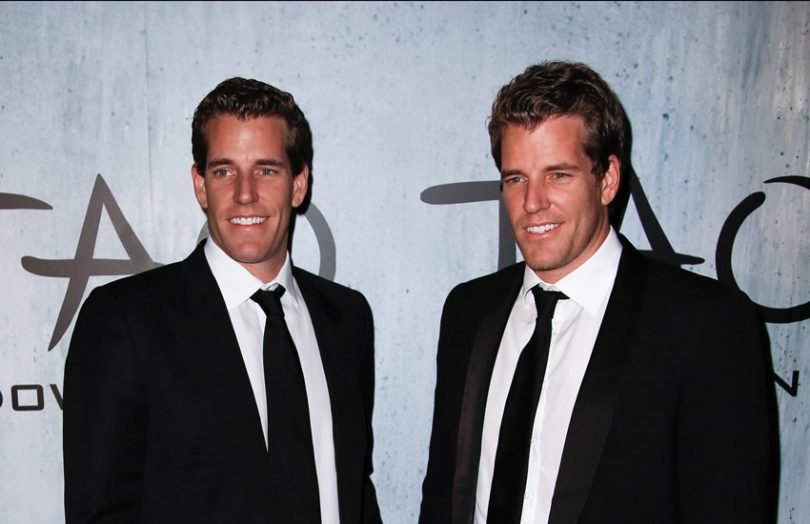

Gemini, the cryptocurrency exchange launched by the Winklevoss twins, has raised its first outside investment in a $400 million funding at a $7.1 billion valuation led by Morgan Creek Digital. Several other organizations participated, including Commonwealth Bank of Australia (CBA) and 10T, a digital asset fund that raised $750 million in October.

Earlier this month, CBA announced it is partnering with Gemini to pilot a cryptocurrency offering to its Australian retail clients.

Apart from the crypto exchange, Gemini currently custodies $30 billion in crypto assets. It also has a cryptocurrency lending product Gemini Earn – the sort that has attracted SEC Chair Gary Gensler’s attention – and has originated $4 billion in loans to date. However, Gemini Trust is more regulated than many other exchanges as a NY Trust company and is a qualified custodian.

It was one of the first to launch a non-fungible token marketplace, the Nifty Gateway, long before this year’s boom. So far, it has managed more than $420 million in sales.

Massive fund raises

Yesterday’s news came after numerous other recent funding announcements and rumors. Earlier this week Ethereum development house ConsenSys announced a $200 million funding. And last week, blockchain gaming platform Forte raised $725 million. Goldman Sachs-backed blockchain infrastructure firm Blockdaemon announced a $155m funding in September, and this week said that JP Morgan and Tiger Global had joined the round.

Plus, several other big rumored rounds are in progress, including for Visa-backed custody firm Anchorage and BNY Mellon-backed custody company Fireblocks which raised $310 million in lateJuly.